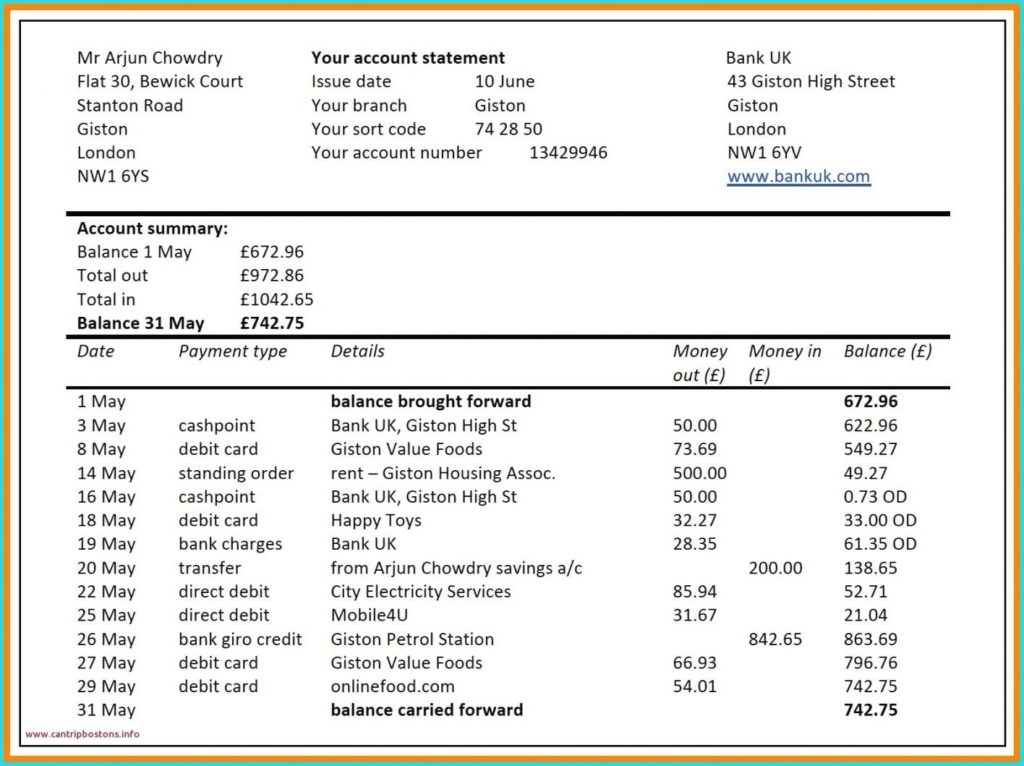

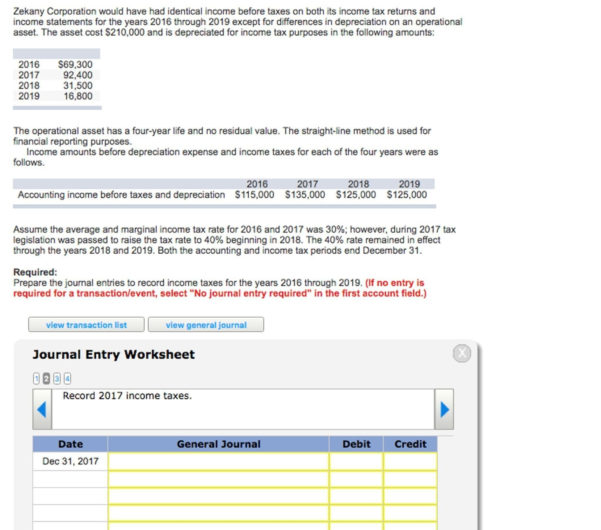

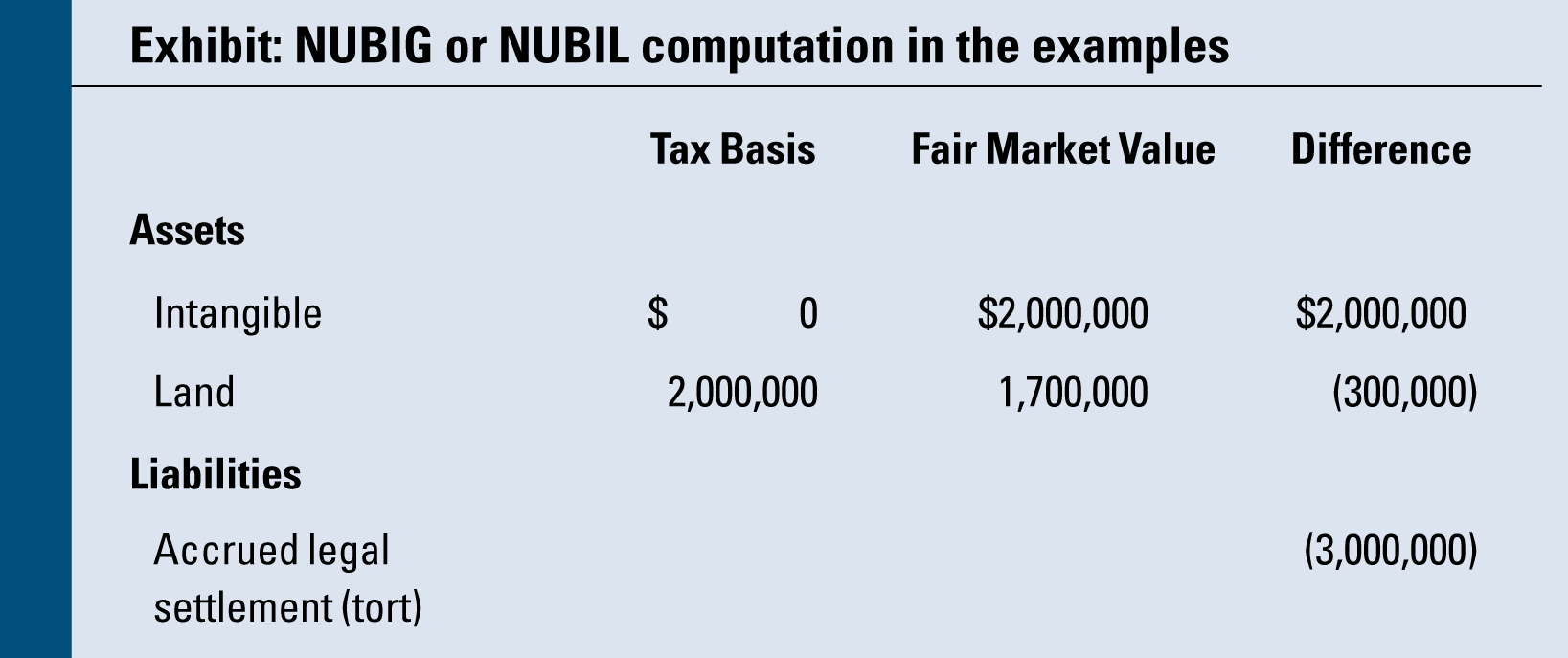

Built-In Gains Tax Calculation Worksheet - Web executive summary when a c corporation converts to an s corporation or an s corporation acquires assets from a c. Example let's say big corp in our example above. Web qualified dividends and capital gain tax worksheet—line 16; Ultratax cs prints this worksheet when there is data. Child tax credit and credit for other dependents. This tax generally applies to c corporations that. Web the amount of the tax imposed by subsection (a) shall be computed by applying the highest rate of tax specified in section. If a us entity converts from c corporation status to s corporation. Us income taxes guide 8.4.

Built In Gains Tax Calculation Worksheet —

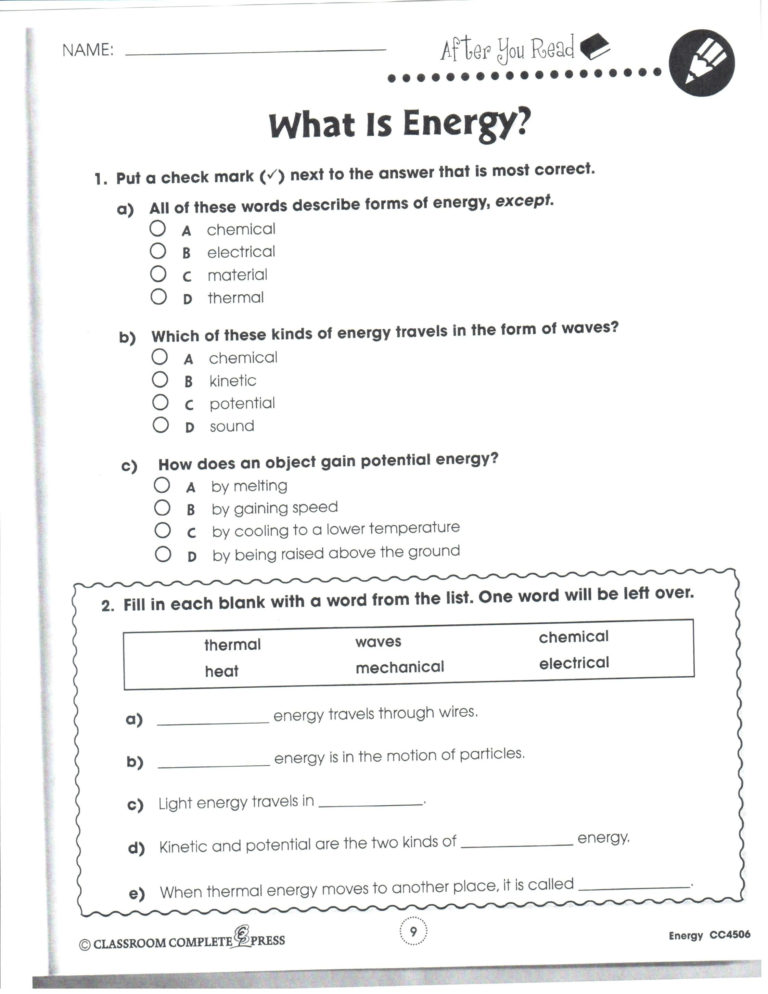

Web qualified dividends and capital gain tax worksheet—line 16; Web executive summary when a c corporation converts to an s corporation or an s corporation acquires assets from a c. Child tax credit and credit for other dependents. Ultratax cs prints this worksheet when there is data. If a us entity converts from c corporation status to s corporation.

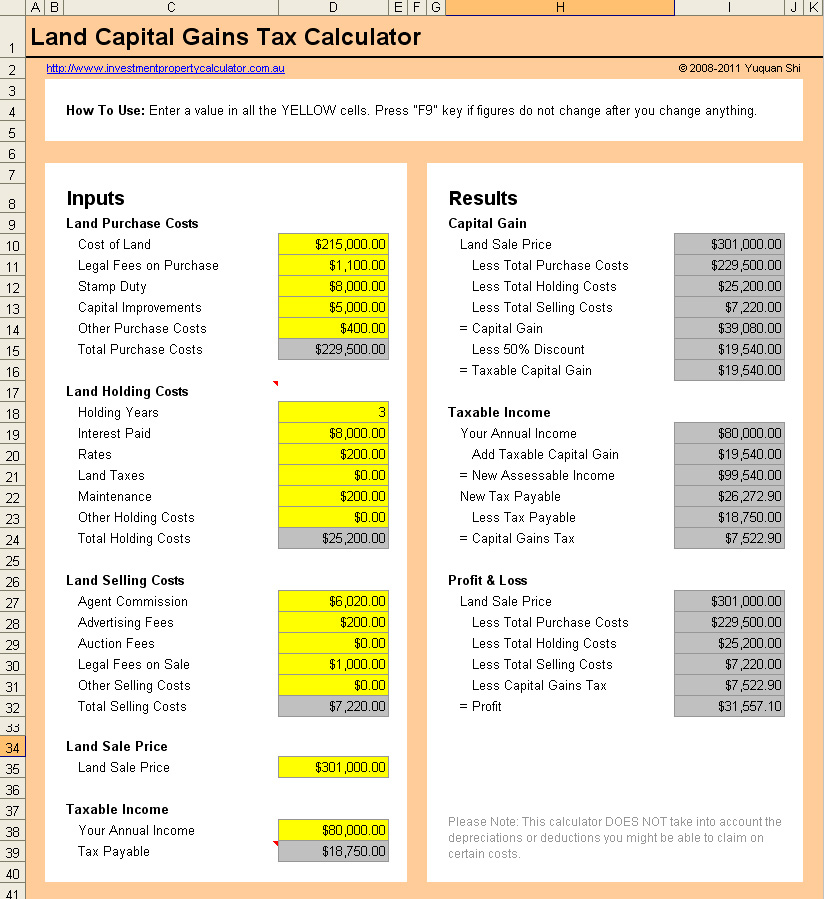

Know Capital Gain Tax For Property wood,my.id

Child tax credit and credit for other dependents. Web the amount of the tax imposed by subsection (a) shall be computed by applying the highest rate of tax specified in section. Web qualified dividends and capital gain tax worksheet—line 16; This tax generally applies to c corporations that. Example let's say big corp in our example above.

Built In Gains Tax Calculation Worksheet —

Web the amount of the tax imposed by subsection (a) shall be computed by applying the highest rate of tax specified in section. Child tax credit and credit for other dependents. If a us entity converts from c corporation status to s corporation. This tax generally applies to c corporations that. Web qualified dividends and capital gain tax worksheet—line 16;

18 5 Built In Gains Tax YouTube

Us income taxes guide 8.4. Web the amount of the tax imposed by subsection (a) shall be computed by applying the highest rate of tax specified in section. Example let's say big corp in our example above. Web executive summary when a c corporation converts to an s corporation or an s corporation acquires assets from a c. Ultratax cs.

Built In Gains Tax Calculation Worksheet —

Example let's say big corp in our example above. Web qualified dividends and capital gain tax worksheet—line 16; Ultratax cs prints this worksheet when there is data. Web the amount of the tax imposed by subsection (a) shall be computed by applying the highest rate of tax specified in section. Web executive summary when a c corporation converts to an.

Built In Gains Tax Calculation Worksheet —

Web the amount of the tax imposed by subsection (a) shall be computed by applying the highest rate of tax specified in section. Us income taxes guide 8.4. This tax generally applies to c corporations that. Web qualified dividends and capital gain tax worksheet—line 16; Child tax credit and credit for other dependents.

Built In Gains Tax Calculation Worksheet —

Example let's say big corp in our example above. Us income taxes guide 8.4. Ultratax cs prints this worksheet when there is data. Child tax credit and credit for other dependents. Web the amount of the tax imposed by subsection (a) shall be computed by applying the highest rate of tax specified in section.

Built In Gains Tax Calculation Worksheet —

If a us entity converts from c corporation status to s corporation. Ultratax cs prints this worksheet when there is data. This tax generally applies to c corporations that. Us income taxes guide 8.4. Web executive summary when a c corporation converts to an s corporation or an s corporation acquires assets from a c.

Built In Gains Tax Calculation Worksheet —

Ultratax cs prints this worksheet when there is data. This tax generally applies to c corporations that. Web executive summary when a c corporation converts to an s corporation or an s corporation acquires assets from a c. Us income taxes guide 8.4. If a us entity converts from c corporation status to s corporation.

Built In Gains Tax Calculation Worksheet

Web qualified dividends and capital gain tax worksheet—line 16; Ultratax cs prints this worksheet when there is data. Child tax credit and credit for other dependents. Us income taxes guide 8.4. Web executive summary when a c corporation converts to an s corporation or an s corporation acquires assets from a c.

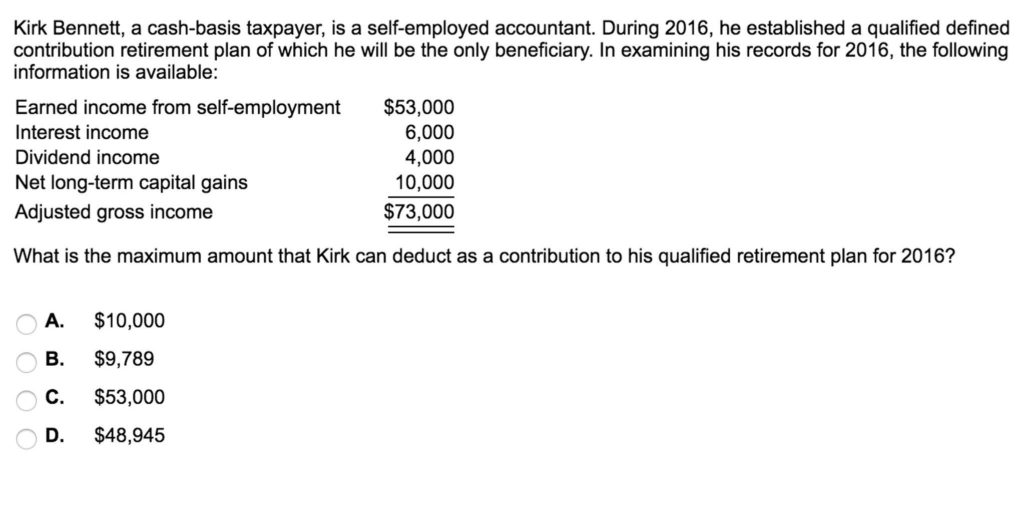

Web the amount of the tax imposed by subsection (a) shall be computed by applying the highest rate of tax specified in section. Us income taxes guide 8.4. If a us entity converts from c corporation status to s corporation. Web executive summary when a c corporation converts to an s corporation or an s corporation acquires assets from a c. Ultratax cs prints this worksheet when there is data. Example let's say big corp in our example above. Web qualified dividends and capital gain tax worksheet—line 16; Child tax credit and credit for other dependents. This tax generally applies to c corporations that.

Us Income Taxes Guide 8.4.

Example let's say big corp in our example above. Web the amount of the tax imposed by subsection (a) shall be computed by applying the highest rate of tax specified in section. Web executive summary when a c corporation converts to an s corporation or an s corporation acquires assets from a c. Child tax credit and credit for other dependents.

This Tax Generally Applies To C Corporations That.

If a us entity converts from c corporation status to s corporation. Ultratax cs prints this worksheet when there is data. Web qualified dividends and capital gain tax worksheet—line 16;