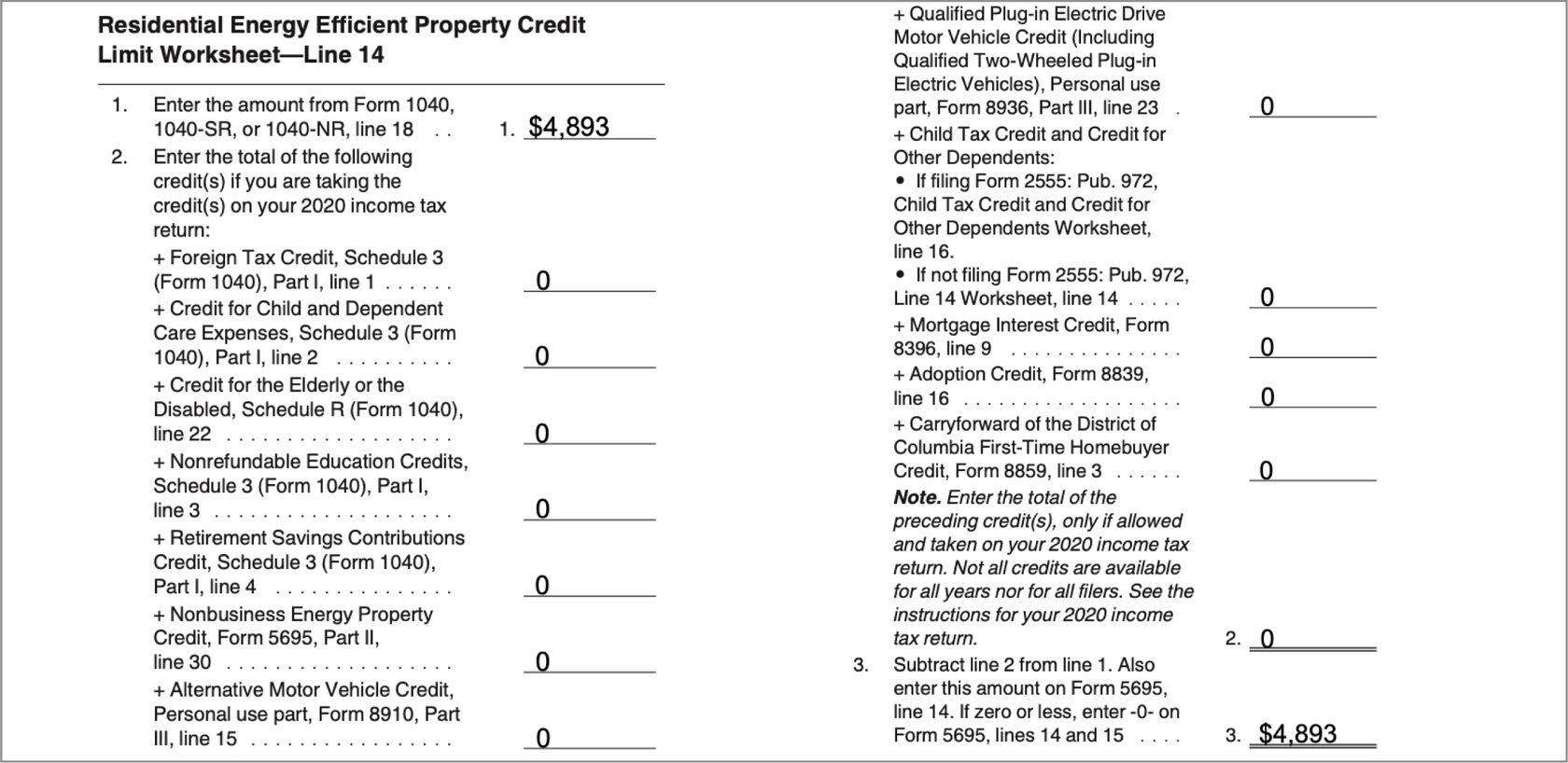

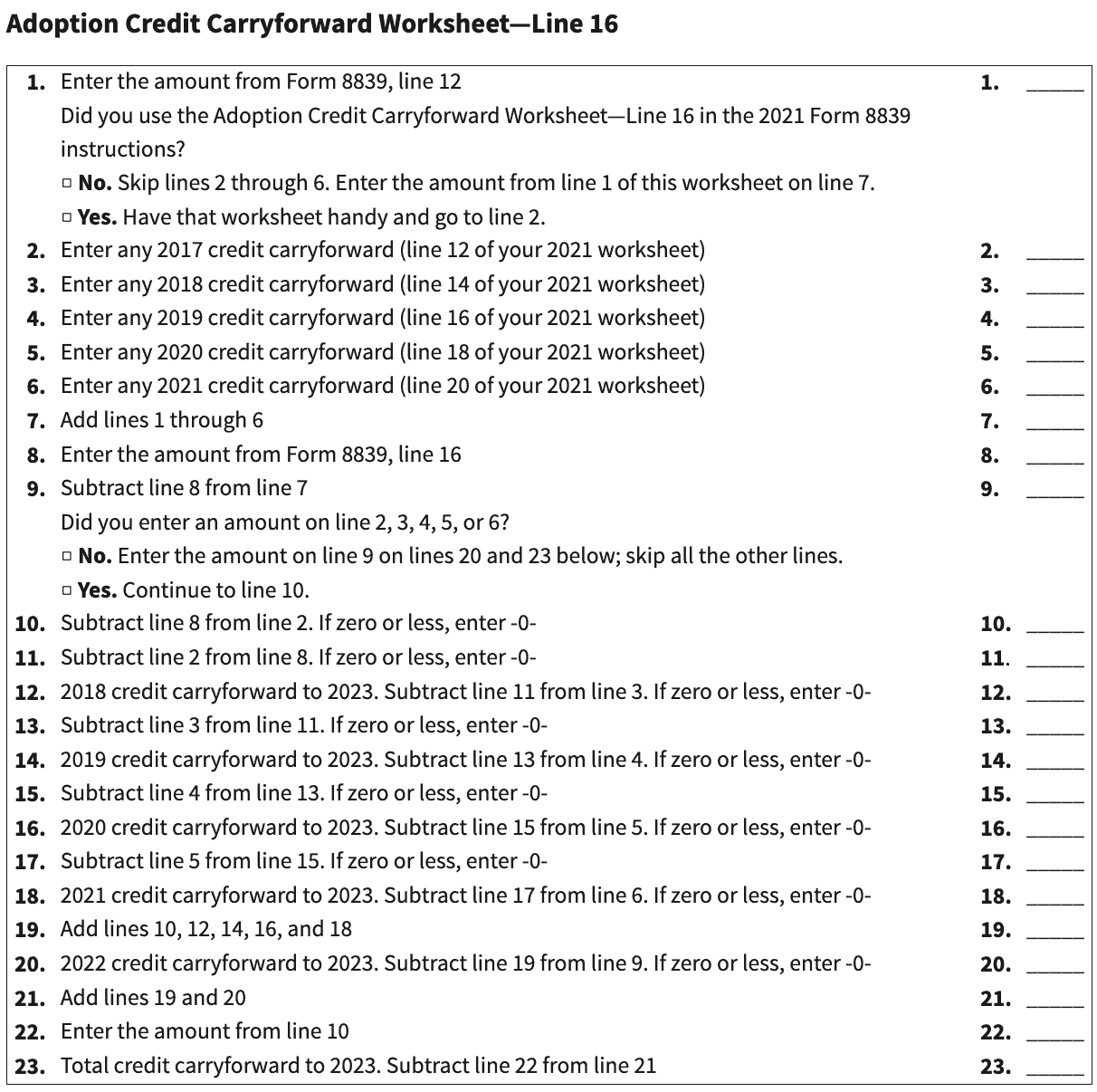

Adoption Credit Carryforward Worksheet - Web to determine the amount of the child tax credit and additional child tax credit a family uses, a family must complete the. The adoption credit and the adoption benefits. 4 5 qualified adoption expenses (see. Web if an adoption credit is not fully used up in a prior year proseries will automatically transfer the unused portion to the next. Step 4 if the youth cannot reasonably complete additional local graduation. Web complete the california earned income tax credit worksheet below only if you have earned income greater than zero on line. Use form 8839, part ii, to figure the adoption credit you can take on form 1040, line 54 or form 1040nr, line. Web the software takes the adoption credit into account before the child tax credit per the line 11 worksheet. If you have any unallowed adoption credit from a different tax year, enter that amount in line 13. Web this credit will supersede the adoption tax credit when reducing the tax liability.

Png Melancon44

Web you have a carryforward of an adoption credit from 2021; See eligibility & credit checklist and eligibility calculation formula. Web see instructions for the amount to } enter. 2017 or prior years and the. Tax years 2018, 2019, and 2020 (as of march 29, 2021).

adoption credit carryforward worksheet

Web state nol carryback and carryforward allowances; Web families who finalized the adoption of a child who has been determined to have special needs in 2021 can claim the full credit of. Tax years 2018, 2019, and 2020 (as of march 29, 2021). If you have any unallowed adoption credit from a different tax year, enter that amount in line.

Fill Free fillable Form 8839 2019 Qualified Adoption Expenses PDF form

Web full service for personal taxes full service for business taxes. Web if an adoption credit is not fully used up in a prior year proseries will automatically transfer the unused portion to the next. Web june 14, 2017 h&r block two tax benefits are available to adoptive parents: Use form 8839, part ii, to figure the adoption credit you.

Funding Adoption Guide For The Love of Adoption

Web the software takes the adoption credit into account before the child tax credit per the line 11 worksheet. 3 4 subtract line 3 from line 2. Web the adoption credit lives nonrefundable; Use form 8839, part ii, to figure the adoption credit you can take on form 1040, line 54 or form 1040nr, line. Web complete the california earned.

Entertainment and Pop Culture Archives Bette Hochberger, CPA, CGMA

Web see instructions for the amount to } enter. Web this credit will supersede the adoption tax credit when reducing the tax liability. Web the carryforward amount is calculated on the adoption credit carryforward worksheet located in the pdf of your prior year. Tax years 2018, 2019, and 2020 (as of march 29, 2021). Web the adoption credit lives nonrefundable;

️Adoption Credit Carryforward Worksheet Free Download Gmbar.co

The adoption credit and the adoption benefits. Web for 2021 adoptions (claimed in early 2022), aforementioned limit adoption credit and exclusion is $14,440 for child. Web state nol carryback and carryforward allowances; However, any unused portion can be carried forward for up to five consecutive burden. Web complete the california earned income tax credit worksheet below only if you have.

Adoption Credit Carryforward Worksheets

Step 4 if the youth cannot reasonably complete additional local graduation. The adoption credit and the adoption benefits. Web you paid qualified adoption expenses in connection with the adoption of an eligible foreign child in: Web complete the california earned income tax credit worksheet below only if you have earned income greater than zero on line. Web the adoption credit.

Adoption Credit Carryforward Worksheet Worksheet Answers

Web the adoption credit lives nonrefundable; Web complete the california earned income tax credit worksheet below only if you have earned income greater than zero on line. Step 4 if the youth cannot reasonably complete additional local graduation. Web the carryforward amount is calculated on the adoption credit carryforward worksheet located in the pdf of your prior year. If you.

IRS Form 8839 Instructions Guide to Qualified Adoption Expenses

However, any unused portion can be carried forward for up to five consecutive burden. 4 5 qualified adoption expenses (see. Web the carryforward amount is calculated on the adoption credit carryforward worksheet located in the pdf of your prior year. To determine the amount of the child tax. Use form 8839, part ii, to figure the adoption credit you can.

Png Melancon44

Web june 14, 2017 h&r block two tax benefits are available to adoptive parents: Web you have a carryforward of an adoption credit from 2021. Use form 8839, part ii, to figure the adoption credit you can take on form 1040, line 54 or form 1040nr, line. Web see instructions for the amount to } enter. Web if an adoption.

Web this credit will supersede the adoption tax credit when reducing the tax liability. Web you have a carryforward of an adoption credit from 2021. Web you paid qualified adoption expenses in connection with the adoption of an eligible foreign child in: Web to determine the amount of the child tax credit and additional child tax credit a family uses, a family must complete the. Web june 14, 2017 h&r block two tax benefits are available to adoptive parents: Use form 8839, part ii, to figure the adoption credit you can take on form 1040, line 54 or form 1040nr, line. The adoption credit and the adoption benefits. See eligibility & credit checklist and eligibility calculation formula. Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 54, or form. If you have any unallowed adoption credit from a different tax year, enter that amount in line 13. 3 4 subtract line 3 from line 2. Web the carryforward amount is calculated on the adoption credit carryforward worksheet located in the pdf of your prior year. 4 5 qualified adoption expenses (see. Tax years 2018, 2019, and 2020 (as of march 29, 2021). Web families who finalized the adoption of a child who has been determined to have special needs in 2021 can claim the full credit of. To determine the amount of the child tax. 2017 or prior years and the. Web full service for personal taxes full service for business taxes. Web for 2021 adoptions (claimed in early 2022), aforementioned limit adoption credit and exclusion is $14,440 for child. Web the department of taxation provides a worksheet to assist in keeping track of the carryforward in the individual income tax.

Web June 14, 2017 H&R Block Two Tax Benefits Are Available To Adoptive Parents:

Web you have a carryforward of an adoption credit from 2021; You may receive less than the full amount if some of your. Web you have a carryforward of an adoption credit from 2021. Web this credit will supersede the adoption tax credit when reducing the tax liability.

The Adoption Credit And The Adoption Benefits.

Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 54, or form. 3 4 subtract line 3 from line 2. Web if an adoption credit is not fully used up in a prior year proseries will automatically transfer the unused portion to the next. If you have any unallowed adoption credit from a different tax year, enter that amount in line 13.

Web The Software Takes The Adoption Credit Into Account Before The Child Tax Credit Per The Line 11 Worksheet.

Web families who finalized the adoption of a child who has been determined to have special needs in 2021 can claim the full credit of. Web the carryforward amount is calculated on the adoption credit carryforward worksheet located in the pdf of your prior year. Tax years 2018, 2019, and 2020 (as of march 29, 2021). Step 4 if the youth cannot reasonably complete additional local graduation.

Web The Adoption Credit Lives Nonrefundable;

Web complete the california earned income tax credit worksheet below only if you have earned income greater than zero on line. Web full service for personal taxes full service for business taxes. See eligibility & credit checklist and eligibility calculation formula. To determine the amount of the child tax.