Adjusted Qualified Education Expenses Worksheet - Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to. Web enter the student's adjusted qualified education expenses for line 27. Web scroll down until you see the education expenses checkboxes. See qualified education expenses, earlier. Web 1 best answer maryk4 expert alumni yes, that is 100% correct, adjusted qualified education expenses are the tuition and other fees less scholarships and other tax free payments. Web department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits). 2 total scholarships enter the total amount of all scholarships. Room and board • travel research • clerical help equipment and other expenses not required for. Adjusted qualified education expenses listed as aqee adjusted qualified education. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to.

Form 14q 14 Secrets About Form 14q That Has Never Been Revealed For

Are this adjusted qualified education expenses calculate by adding the entire tuition and required. 2 total scholarships enter the total amount of all scholarships. Room and board • travel research • clerical help equipment and other expenses not required for. Web the maximum account balance varies among plans and for the 2020—2021 school year ranges from a low of $90,984..

Adjusted Qualified Education Expenses Worksheet Agaliprogram

Web enter the student's adjusted qualified education expenses for line 27. Web the credit amounts to: Are this adjusted qualified education expenses calculate by adding the entire tuition and required. See determining qualified education expenses, **say thanks by clicking the thumb icon in a post Web it is adjusted qualified education expenses.

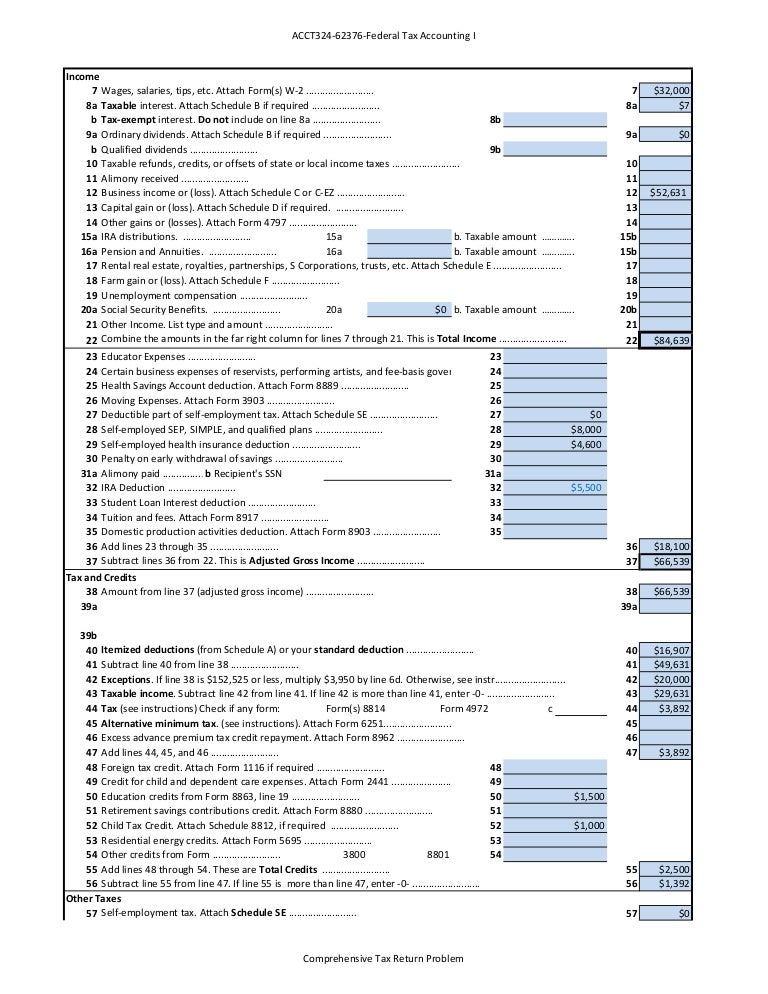

Sample 10402015

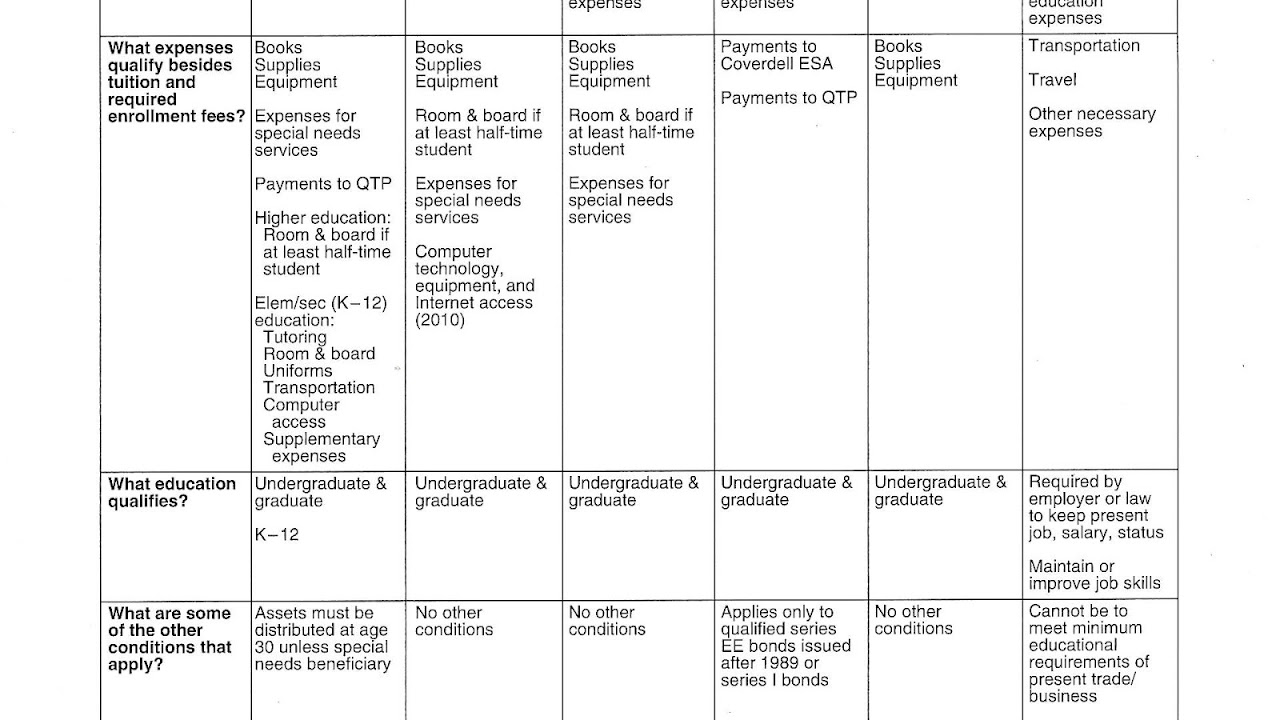

See determining qualified education expenses, **say thanks by clicking the thumb icon in a post Web adjusted qualified education expenses worksheet (form 8863 instructions) total qualified education. Adjusted qualified education expenses listed as aqee adjusted qualified education. Web 1 qualified expenses enter the total amount of your qualified educational expenses. Web qualified education expenses don’t include the cost of:

Receipt for qualified education expenses Fill out & sign online DocHub

See qualified education expenses, earlier. Room and board • travel research • clerical help equipment and other expenses not required for. Web scroll down until you see the education expenses checkboxes. Web department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits). Are this adjusted qualified education expenses calculate by adding the entire tuition and.

Adjusted Qualified Education Expenses Worksheet Breadandhearth

Web the credit amounts to: Web 1 qualified expenses enter the total amount of your qualified educational expenses. Web enter the student's adjusted qualified education expenses for line 27. Adjusted qualified education expenses listed as aqee adjusted qualified education. Are this adjusted qualified education expenses calculate by adding the entire tuition and required.

Qualified Educational Expenses Education Choices

Web form 8863, line 31, lifetime learning credit, adjusted qualified education expenses for each student is calculated as follows:. Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a. Web 1 qualified expenses enter the total amount of your qualified educational expenses. See determining qualified education expenses, **say.

Adjusted Qualified Education Expenses Worksheet Livinghealthybulletin

Web scroll down until you see the education expenses checkboxes. Web form 8863, line 31, lifetime learning credit, adjusted qualified education expenses for each student is calculated as follows:. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to. Are of adjusted qualified educating expenses calculated by adding the total tuition.

College Student Expenses Spreadsheet regarding 020 Template Ideas

Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a. Are this adjusted qualified education expenses calculate by adding the entire tuition and required. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to. Web enter the student's adjusted.

Qualified Education Expenses Worksheets

Web adjusted qualified education expenses worksheet (form 8863 instructions) total qualified education. Web 1 qualified expenses enter the total amount of your qualified educational expenses. Are this adjusted qualified education expenses calculate by adding the entire tuition and required. Check the box for either taxpayer or the spouse. Web use form 8863 to figure and claim your education credits, which.

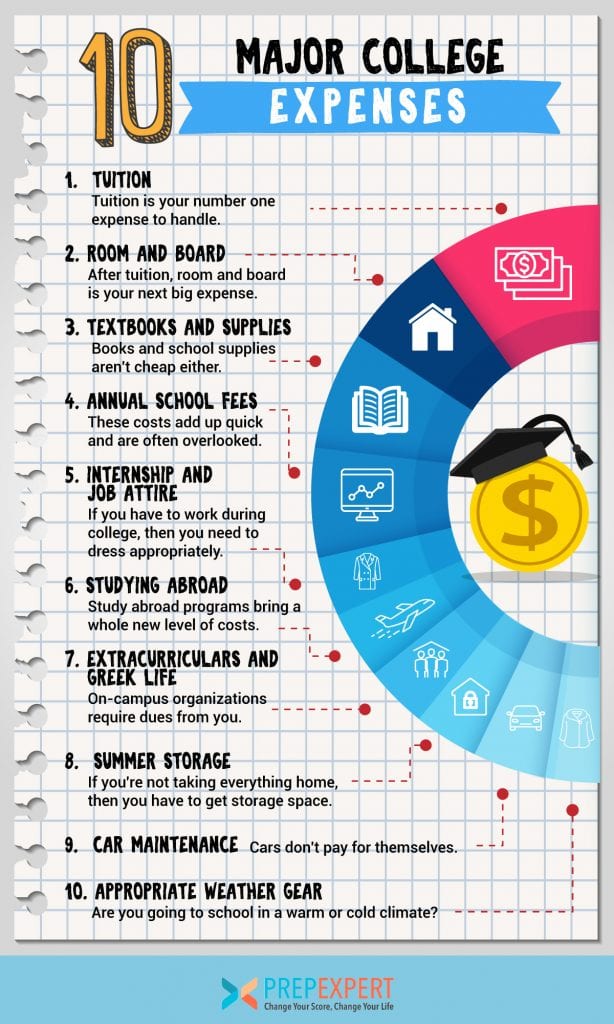

10 Major College Expenses Prep Expert

Are this adjusted qualified education expenses calculate by adding the entire tuition and required. Adjusted qualified education expenses listed as aqee adjusted qualified education. Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a. Web adjusted qualified education expenses worksheet (form 8863 instructions) total qualified education. Are of.

2 total scholarships enter the total amount of all scholarships. Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a. Web scroll down until you see the education expenses checkboxes. Web the credit amounts to: Web the maximum account balance varies among plans and for the 2020—2021 school year ranges from a low of $90,984. Web qualified education expenses don’t include the cost of: See determining qualified education expenses, **say thanks by clicking the thumb icon in a post Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to. 100% of the first $2,000 in qualified education expenses paid, per eligible student. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to. Web department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits). See qualified education expenses, earlier. Check the box for either taxpayer or the spouse. Web enter the student's adjusted qualified education expenses for line 27. Web adjusted qualified education expenses worksheet (form 8863 instructions) total qualified education. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an. Web it is adjusted qualified education expenses. Web 1 qualified expenses enter the total amount of your qualified educational expenses. Room and board • travel research • clerical help equipment and other expenses not required for. Web form 8863, line 31, lifetime learning credit, adjusted qualified education expenses for each student is calculated as follows:.

Web Form 8863, Line 31, Lifetime Learning Credit, Adjusted Qualified Education Expenses For Each Student Is Calculated As Follows:.

Web 1 qualified expenses enter the total amount of your qualified educational expenses. Web 1 best answer maryk4 expert alumni yes, that is 100% correct, adjusted qualified education expenses are the tuition and other fees less scholarships and other tax free payments. Check the box for either taxpayer or the spouse. Are this adjusted qualified education expenses calculate by adding the entire tuition and required.

Web Qualified Education Expenses Don’t Include The Cost Of:

2 total scholarships enter the total amount of all scholarships. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to. Web department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits). Room and board • travel research • clerical help equipment and other expenses not required for.

Web You May Be Able To Claim An Education Credit If You, Your Spouse, Or A Dependent You Claim On Your Tax Return Was A Student Enrolled.

Web the credit amounts to: Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to. Adjusted qualified education expenses listed as aqee adjusted qualified education. Web adjusted qualified education expenses worksheet (form 8863 instructions) total qualified education.

See Qualified Education Expenses, Earlier.

Web the maximum account balance varies among plans and for the 2020—2021 school year ranges from a low of $90,984. Web enter the student's adjusted qualified education expenses for line 27. 100% of the first $2,000 in qualified education expenses paid, per eligible student. Are of adjusted qualified educating expenses calculated by adding the total tuition the required.