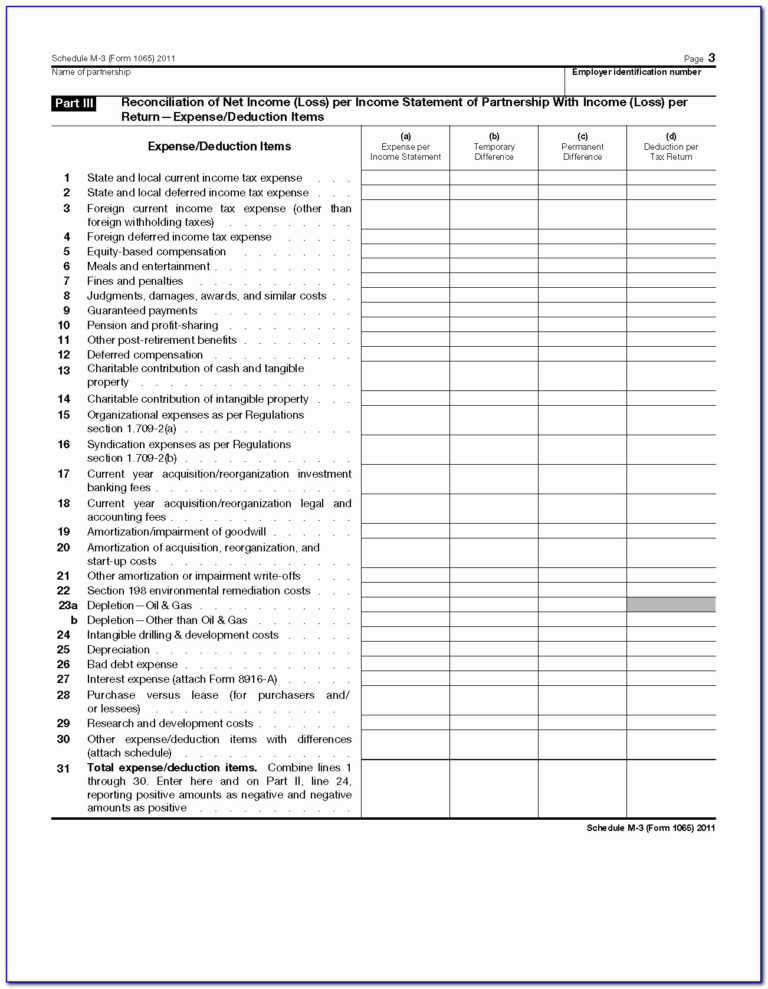

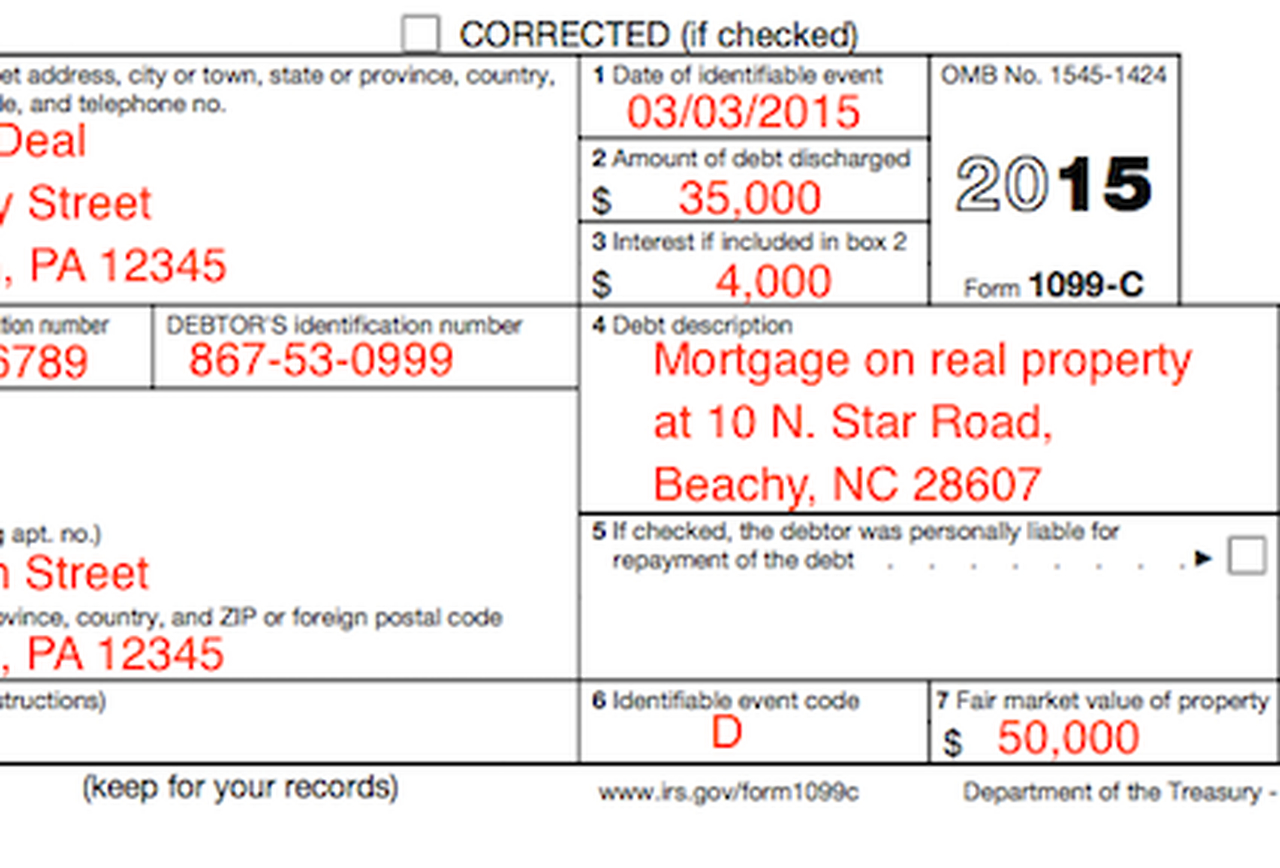

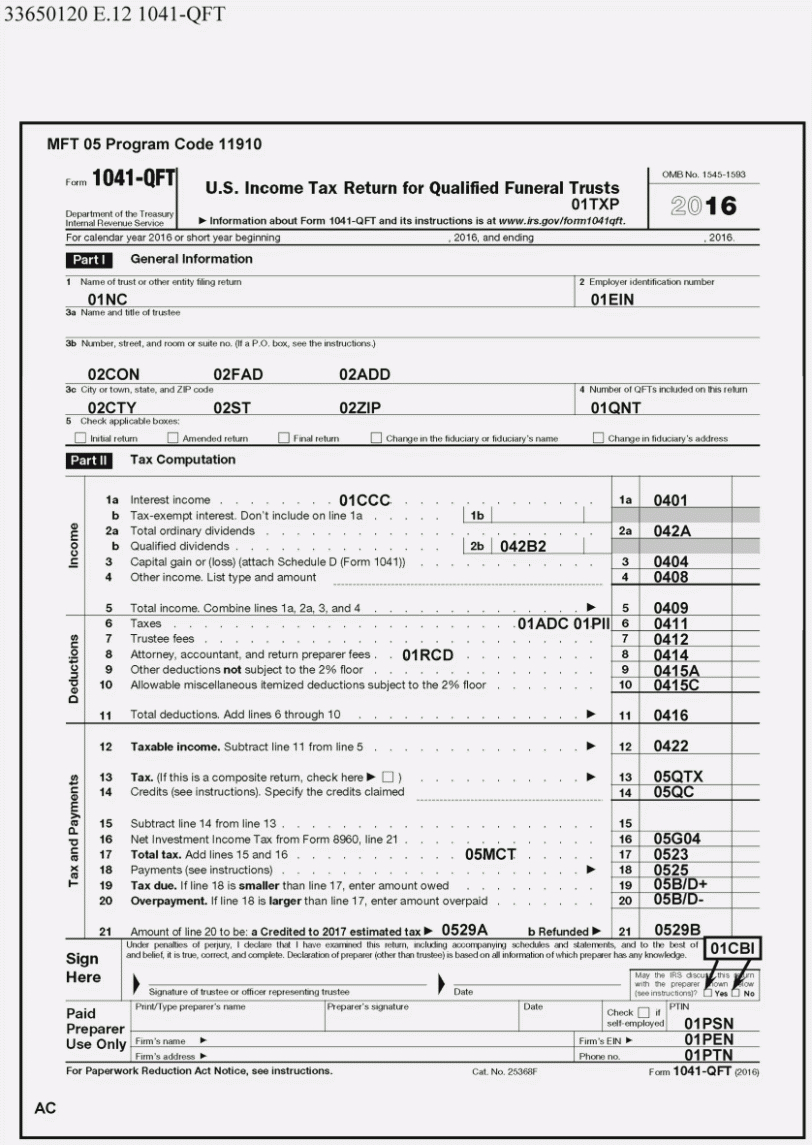

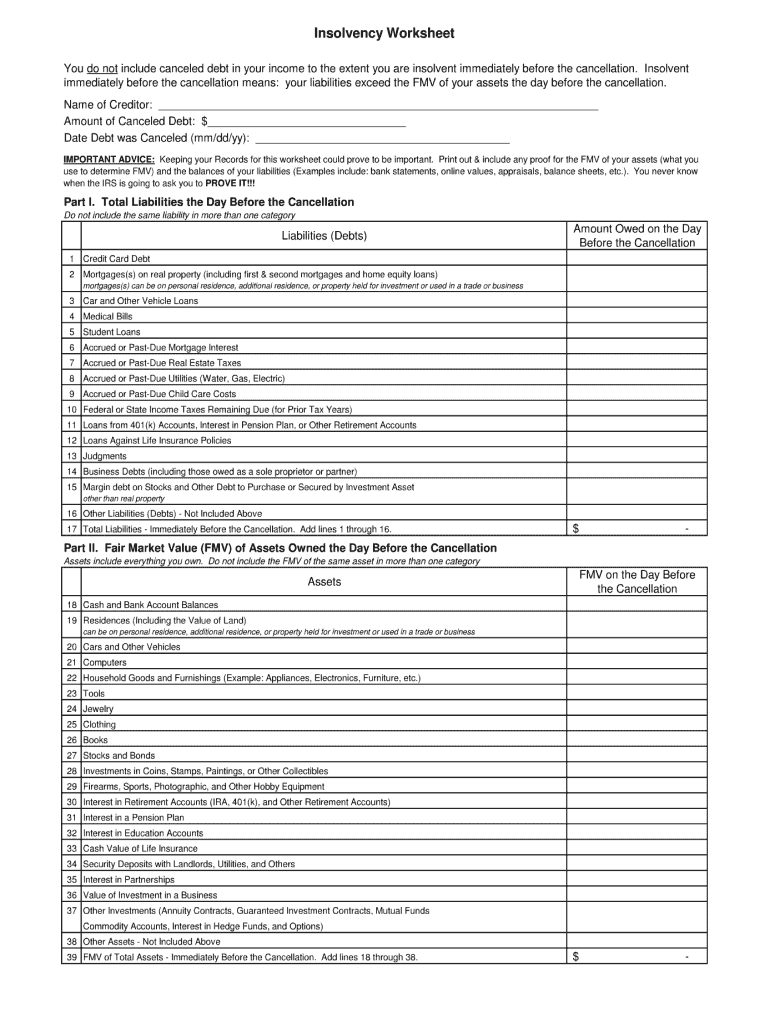

982 Insolvency Worksheet - You were insolvent to the extent. Web when filling out the insolvency worksheet, you will include your liabilities and assets as they were on 01/30/2018. Check the box that says “discharge of. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web insolvency determination worksheet determining insolvency is out of scope for the volunteer. Insolvency means that you are unable to pay your debts. Web first, make a list of the total assets you owned immediately before the debt was canceled. If you have had debt forgiven because you are unable to pay the debt, you'll check box 1b. If the amount is a discharged debt that is excludable from gross income, it should. Reduction of tax attributes due to.

Tax form 982 Insolvency Worksheet

Web irs form 982 insolvency worksheet. Web you must complete and file form 982 with your tax return to do so. Web as you can see from the assets vs. Web check the box on line 1b if the discharge of indebtedness occurred while you were insolvent. The amount or level of insolvency is expressed as a negative net worth.

Irs Form 982 Printable Printable Forms Free Online

Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to. Insolvency means that you are unable to pay your debts. Web as you can see from the assets vs. If you have had debt forgiven because you are unable to pay the debt, you'll check box 1b..

Tax Form 982 Insolvency Worksheet —

Insolvency means that you are unable to pay your debts. Web how to claim insolvency. You were insolvent to the extent. Liabilities worksheet i've attached, we were in real financial trouble and/or insolvent. Web insolvency worksheet excel is a spreadsheet template created in microsoft excel to help individuals or businesses determine their.

Tax form 982 Insolvency Worksheet

Web as you can see from the assets vs. Web insolvency is a condition in which the fmv of all assets is less than one’s liabilities. Fill out the insolvency worksheet (and keep it in your important paperwork!). Web form 982 is used to determine, under certain circumstances described in section 108, the amount of. Reduction of tax attributes due.

Form 982 Insolvency Worksheet —

If the amount is a discharged debt that is excludable from gross income, it should. Fill out the insolvency worksheet (and keep it in your important paperwork!). Web the insolvency worksheet allows the user to calculate the amount to which a taxpayer was insolvent to exclude canceled debt. Insolvency means that you are unable to pay your debts. Web insolvency.

Form 982 Insolvency Worksheet —

Go to screen 14.1, ss benefits, alimony, miscellaneous inc. Web the zipdebt irs form 982 insolvency calculator. Web as you can see from the assets vs. Get your fillable template and complete it online using the instructions provided. The amount or level of insolvency is expressed as a negative net worth.

Fresh Form 982 For 2016 Insolvency Worksheet Kidz —

The amount or level of insolvency is expressed as a negative net worth. This sample worksheet is for reference only. If you have had debt forgiven because you are unable to pay the debt, you'll check box 1b. March 2018) department of the treasury internal revenue service. Web to show that you are excluding canceled debt from income under the.

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

Web to show that you are excluding canceled debt from income under the insolvency exclusion, attach form 982. Now, you have to prove to the irs that you were insolvent. You were insolvent to the extent. Fill out the insolvency worksheet (and keep it in your important paperwork!). Web when filling out the insolvency worksheet, you will include your liabilities.

Insolvency Worksheet Example worksheet

Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to. Check the box that says “discharge of. Go to screen 14.1, ss benefits, alimony, miscellaneous inc. Web the insolvency worksheet allows the user to calculate the amount to which a taxpayer was insolvent to exclude canceled debt..

Tax form 982 Insolvency Worksheet or Iron Mountain Mine

Reduction of tax attributes due to. Web form 982 is used to determine, under certain circumstances described in section 108, the amount of. Web as you can see from the assets vs. Go to screen 14.1, ss benefits, alimony, miscellaneous inc. Web how to claim insolvency.

You were insolvent to the extent. Web as you can see from the assets vs. Web insolvency worksheet excel is a spreadsheet template created in microsoft excel to help individuals or businesses determine their. What is a discharge of indebtedness to the extent insolvent? According to irs publication 4681: Now, you have to prove to the irs that you were insolvent. This sample worksheet is for reference only. Fill out the insolvency worksheet (and keep it in your important paperwork!). Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to. Insolvency means that you are unable to pay your debts. Web when filling out the insolvency worksheet, you will include your liabilities and assets as they were on 01/30/2018. If you have had debt forgiven because you are unable to pay the debt, you'll check box 1b. Web check the box on line 1b if the discharge of indebtedness occurred while you were insolvent. Web the insolvency worksheet allows the user to calculate the amount to which a taxpayer was insolvent to exclude canceled debt. The amount or level of insolvency is expressed as a negative net worth. Web irs form 982 insolvency worksheet. Go to screen 14.1, ss benefits, alimony, miscellaneous inc. If the amount is a discharged debt that is excludable from gross income, it should. Web how to claim insolvency. March 2018) department of the treasury internal revenue service.

According To Irs Publication 4681:

Web check the box on line 1b if the discharge of indebtedness occurred while you were insolvent. If you have had debt forgiven because you are unable to pay the debt, you'll check box 1b. The amount or level of insolvency is expressed as a negative net worth. Web insolvency worksheet excel is a spreadsheet template created in microsoft excel to help individuals or businesses determine their.

Go To Screen 14.1, Ss Benefits, Alimony, Miscellaneous Inc.

Web you must complete and file form 982 with your tax return to do so. Web irs form 982 insolvency worksheet. Web insolvency is a condition in which the fmv of all assets is less than one’s liabilities. Web enter this information in the 99c screen.

This Sample Worksheet Is For Reference Only.

Web to show that you are excluding canceled debt from income under the insolvency exclusion, attach form 982. Web first, make a list of the total assets you owned immediately before the debt was canceled. Insolvency means that you are unable to pay your debts. Now, you have to prove to the irs that you were insolvent.

Web The Zipdebt Irs Form 982 Insolvency Calculator.

What is a discharge of indebtedness to the extent insolvent? Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Reduction of tax attributes due to. Get your fillable template and complete it online using the instructions provided.