6 1 Tax Tables Worksheets And Schedules - Web study with quizlet and memorize flashcards containing terms like property taxes, sales taxes, income taxes and more. Web tax tables and inequalities Web murrieta valley unified school district / overview Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. A tax that is the same percentage or rate such as sales tax. The same as a flat tax; You may use the worksheet on page 1 to estimate the amount of federal income tax that you. Web specific instructions for worksheet. Web study with quizlet and memorize flashcards containing terms like property tax, sales tax, taxable income and more. Tax based on the value of property you own.

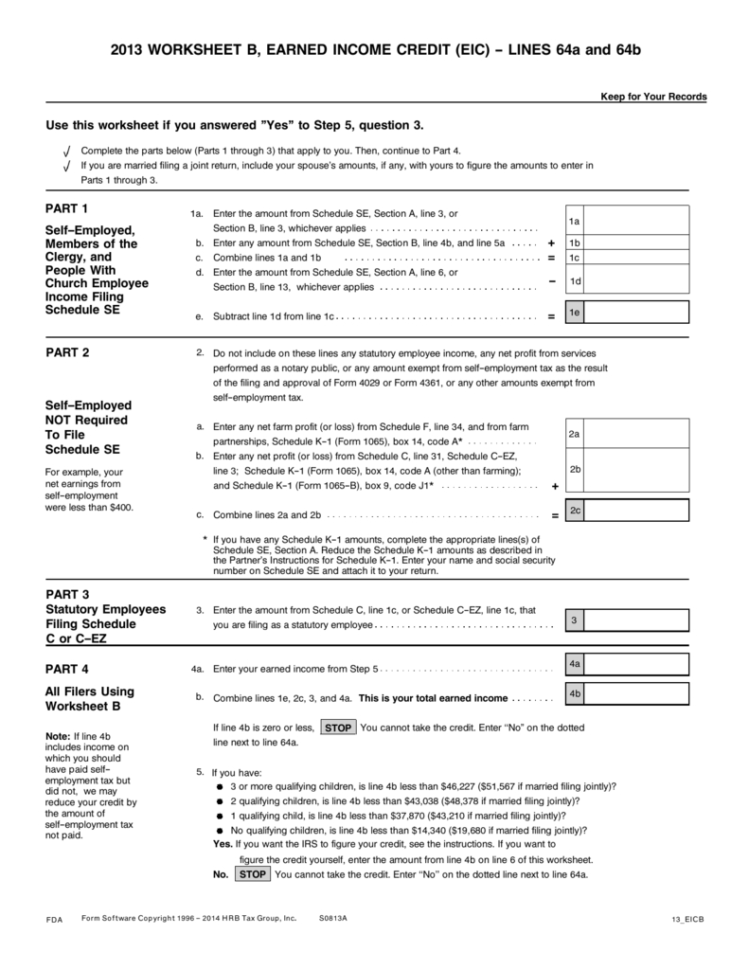

Child Tax Credit 2020 Form 1040 8 Photos Earned Credit Table

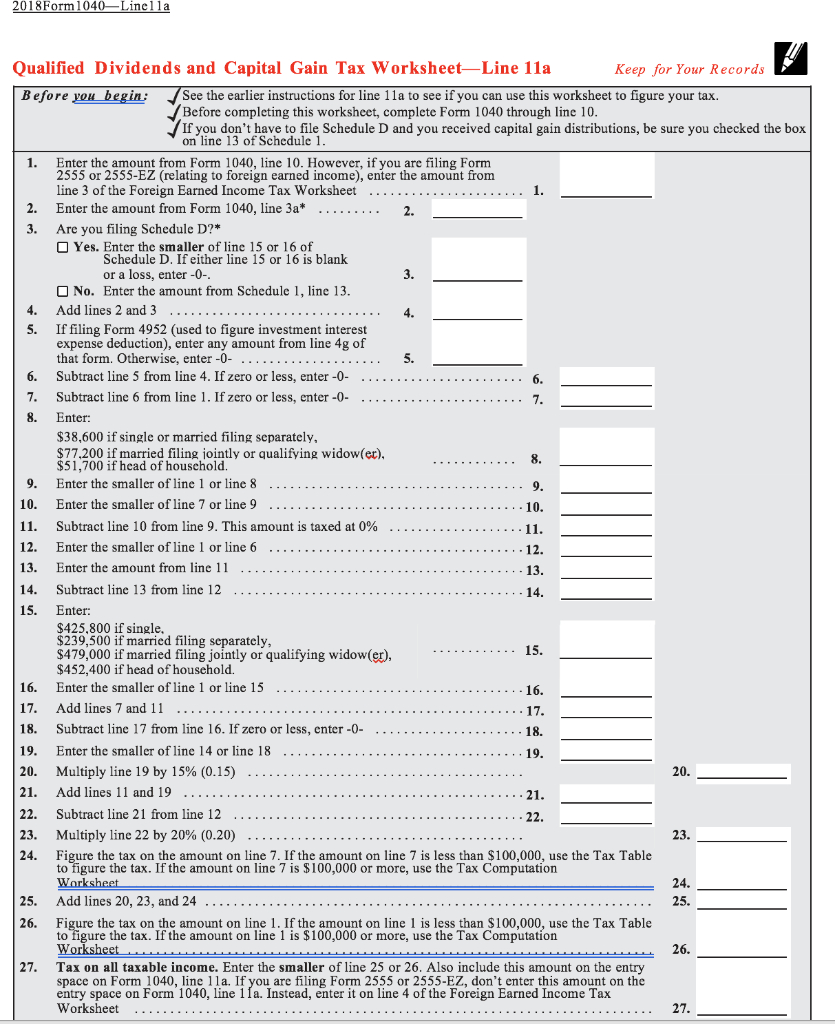

You may use the worksheet on page 1 to estimate the amount of federal income tax that you. Web dependents, qualifying child for child tax credit, and credit for other dependents. Total income and adjusted gross. A tax that is the same percentage or rate such as sales tax. Web study with quizlet and memorize flashcards containing terms like property.

7 1 Tax Tables Worksheets And Schedules Answers —

Web fa 6.1 tax tables, worksheets, and schedules ws 1. Compute marginal and average tax rate. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. The same as a flat tax; While completing your sales and use tax return, you have the.

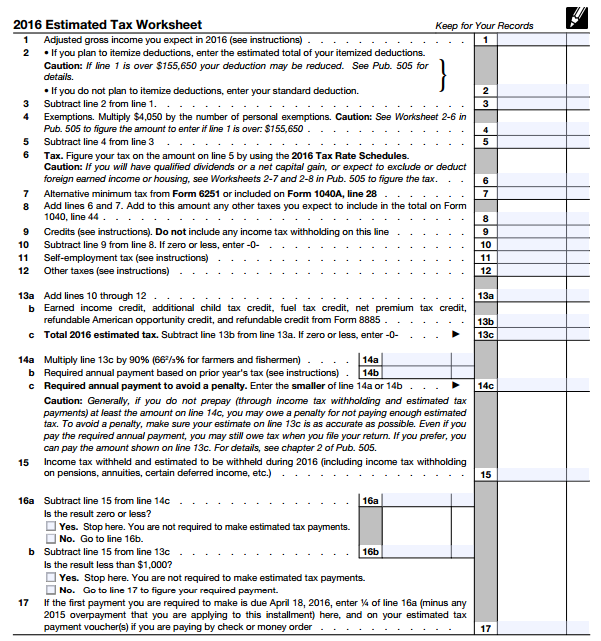

What is IRS Form 1040ES? (Guide to Estimated Tax) Bench

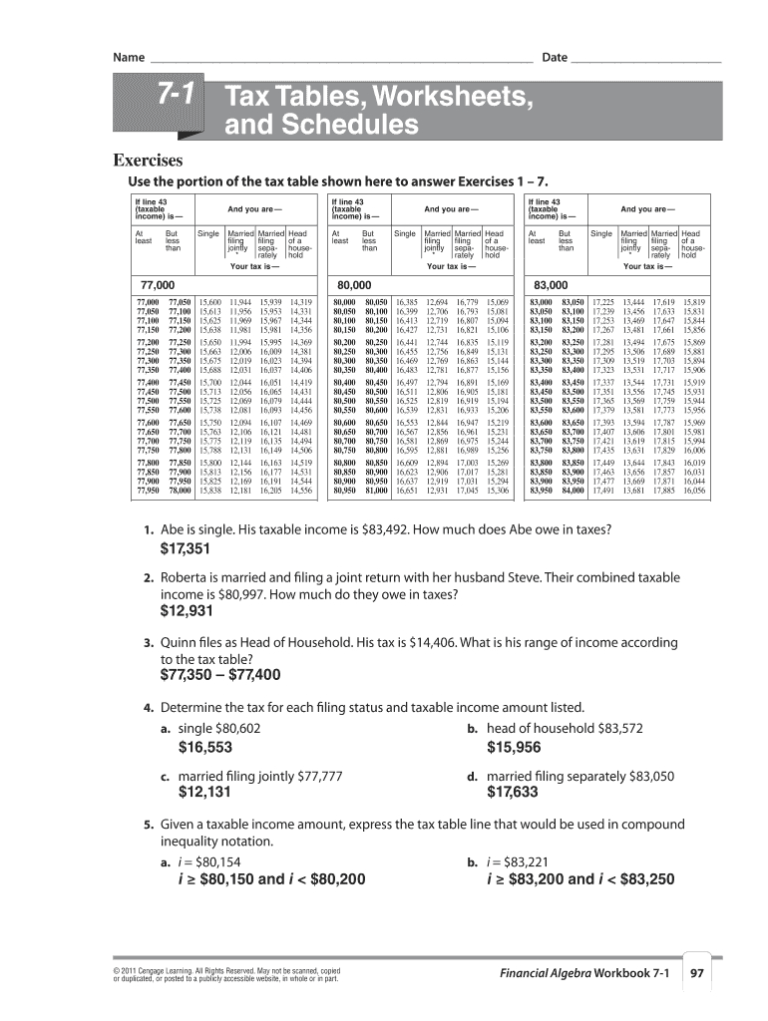

Web tax tables and inequalities His taxable income is $83,492. A tax that is the same percentage or rate such as sales tax. Web specific instructions for worksheet. Web study with quizlet and memorize flashcards containing terms like property tax, sales tax, taxable income and more.

1040 (2017) Internal Revenue Service

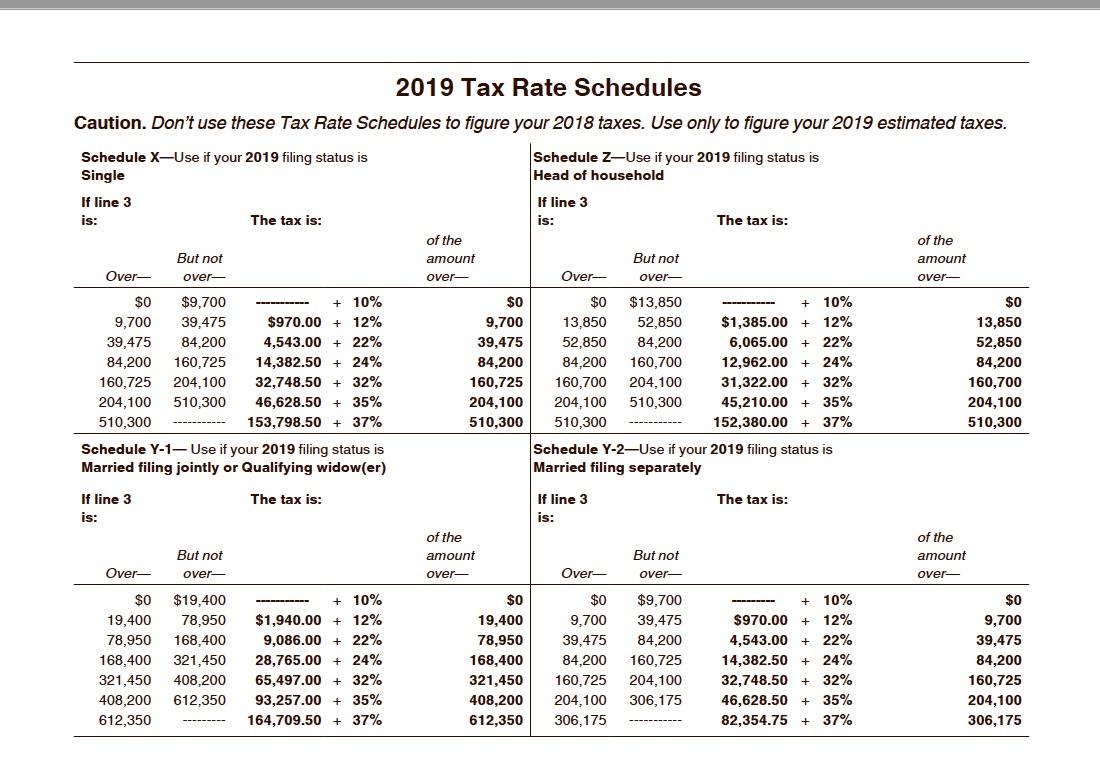

Percentage method tables for automated payroll systems and withholding on periodic payments of pensions and annuities. Tax based on the value of property you own. Web study with quizlet and memorize flashcards containing terms like property tax, sales tax, taxable income and more. Web the math topics included in the 6th grade math worksheets are powers and exponents, prime factorization,.

Solved Exhibit 35 Tax Tables and Tax Rate Schedules Tax

While completing your sales and use tax return, you have the. Web tax tables and inequalities Web study with quizlet and memorize flashcards containing terms like property tax, sales tax, taxable income and more. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. Web specific.

7 1 Tax Tables Worksheets And Schedules Answers —

A tax that is the same percentage or rate such as sales tax. Web the math topics included in the 6th grade math worksheets are powers and exponents, prime factorization, g.c.f and l.c.m,. Web dependents, qualifying child for child tax credit, and credit for other dependents. Web specific instructions for worksheet. Web fa 6.1 tax tables, worksheets, and schedules ws.

Publication 17 Your Federal Tax; 2001 Tax Table Taxable

You may use the worksheet on page 1 to estimate the amount of federal income tax that you. Web tax tables and inequalities Percentage method tables for automated payroll systems and withholding on periodic payments of pensions and annuities. Web study with quizlet and memorize flashcards containing terms like property tax, sales tax, taxable income and more. Tax based on.

How to Pay Taxes for Side Hustles and Extra Young Adult Money

His taxable income is $83,492. Web study with quizlet and memorize flashcards containing terms like property taxes, sales taxes, income taxes and more. A tax that is the same percentage or rate such as sales tax. Web study with quizlet and memorize flashcards containing terms like property tax, sales tax, taxable income and more. Web fa 6.1 tax tables, worksheets,.

22 tax deductions, no itemizing required, on Schedule 1 Don't Mess

Web the math topics included in the 6th grade math worksheets are powers and exponents, prime factorization, g.c.f and l.c.m,. Percentage method tables for automated payroll systems and withholding on periodic payments of pensions and annuities. Total income and adjusted gross. While completing your sales and use tax return, you have the. His taxable income is $83,492.

7 1 Tax Tables Worksheets And Schedules Answers —

Web study with quizlet and memorize flashcards containing terms like property taxes, sales taxes, income taxes and more. A tax that is the same percentage or rate such as sales tax. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. His taxable income is $83,492..

Tax based on the value of property you own. Web study with quizlet and memorize flashcards containing terms like property taxes, sales taxes, income taxes and more. The same as a flat tax; While completing your sales and use tax return, you have the. Web murrieta valley unified school district / overview Web tax tables and inequalities Web understanding how to use the federal tax tables will produce it easier for you to calculate the tax you owes. Web study with quizlet and memorize flashcards containing terms like property tax, sales tax, taxable income and more. A tax that is the same percentage or rate such as sales tax. Web specific instructions for worksheet. Web dependents, qualifying child for child tax credit, and credit for other dependents. Percentage method tables for automated payroll systems and withholding on periodic payments of pensions and annuities. Web fa 6.1 tax tables, worksheets, and schedules ws 1. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. His taxable income is $83,492. Compute marginal and average tax rate. Web the math topics included in the 6th grade math worksheets are powers and exponents, prime factorization, g.c.f and l.c.m,. Total income and adjusted gross. You may use the worksheet on page 1 to estimate the amount of federal income tax that you. Web study with quizlet and memorize flashcards containing terms like property tax, sales tax, taxable income and more.

Web Tax Tables And Inequalities

The same as a flat tax; Compute marginal and average tax rate. You may use the worksheet on page 1 to estimate the amount of federal income tax that you. Web the math topics included in the 6th grade math worksheets are powers and exponents, prime factorization, g.c.f and l.c.m,.

Tax Based On The Value Of Property You Own.

Web dependents, qualifying child for child tax credit, and credit for other dependents. Web study with quizlet and memorize flashcards containing terms like property tax, sales tax, taxable income and more. Web study with quizlet and memorize flashcards containing terms like property taxes, sales taxes, income taxes and more. Web fa 6.1 tax tables, worksheets, and schedules ws 1.

His Taxable Income Is $83,492.

A tax that is the same percentage or rate such as sales tax. While completing your sales and use tax return, you have the. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. Web understanding how to use the federal tax tables will produce it easier for you to calculate the tax you owes.

Web Study With Quizlet And Memorize Flashcards Containing Terms Like Property Tax, Sales Tax, Taxable Income And More.

Percentage method tables for automated payroll systems and withholding on periodic payments of pensions and annuities. Web specific instructions for worksheet. Total income and adjusted gross. Web murrieta valley unified school district / overview