5471 Worksheet A - Web how do i produce form 5471 worksheet a in individual tax using interview forms? December 2012) department of the treasury internal revenue service. Web is 471 a prime number? Web training intuit help intuit common questions about form 5471 in lacerte solved • by intuit • 1 • updated. Below are the questions on worksheet a which should be answered in order to complete line 1c. Line 1a of worksheet a asks the cfc shareholder to disclose “dividends, interest, royalties, and annuities” as per section 954 (c) (1) (a). Citizens and residents who are officers, directors, or shareholders. Go to the section, miscellaneous forms, and then go to the screen, information of u.s. Web go to the following articles to find more information on producing form 5471: Citizens who are officers, directors, or shareholders in certain foreign corporations must file irs form 5471, information return of u.s.

5471 Worksheet A

This is an example of worksheet a, page 2, which is used to determine the shareholder's share of. Citizens and residents who are officers, directors, or shareholders. Citizens who are officers, directors, or shareholders in certain foreign corporations must file irs form 5471, information return of u.s. Below are the questions on worksheet a which should be answered in order.

5471 Worksheet A

Web instructions for form 5471(rev. Web to generate form 5471: This is an example of worksheet a, page 2, which is used to determine the shareholder's share of. In this article, we’ll cover: Line 1a of worksheet a asks the cfc shareholder to disclose “dividends, interest, royalties, and annuities” as per section 954 (c) (1) (a).

5471 Worksheet A

Line 1a of worksheet a asks the cfc shareholder to disclose “dividends, interest, royalties, and annuities” as per section 954 (c) (1) (a). This webinar explains the form. Go to the section, miscellaneous forms, and then go to the screen, information of u.s. Web training intuit help intuit common questions about form 5471 in lacerte solved • by intuit •.

5471 Worksheet A

Web instructions for form 5471(rev. This is an example of worksheet a, page 2, which is used to determine the shareholder's share of. Citizens and residents who are officers, directors, or shareholders. December 2005) file in duplicate information furnished for the foreign corporation’s annual accounting. Web how do i produce form 5471 worksheet a in individual tax using interview forms?

5471 Worksheet A

This webinar explains the form. Web during the tax year, did the foreign corporation own any foreign entities that were disregarded as separate from their owner under regulations sections. Web form 5471 is used by certain u.s. Web training intuit help intuit common questions about form 5471 in lacerte solved • by intuit • 1 • updated. In this article,.

2012 form 5471 instructions Fill out & sign online DocHub

It is possible to find out using mathematical methods whether a given integer is a prime number or not. Web to generate form 5471: Web instructions for form 5471(rev. December 2005) file in duplicate information furnished for the foreign corporation’s annual accounting. Citizens and residents who are officers, directors, or shareholders.

Form 5471, Page 1 YouTube

Web training intuit help intuit common questions about form 5471 in lacerte solved • by intuit • 1 • updated. Web go to the following articles to find more information on producing form 5471: Citizens and residents who are officers, directors, or shareholders. Web instructions for form 5471(rev. Line 1a of worksheet a asks the cfc shareholder to disclose “dividends,.

Printable Order of Operations Worksheets Quizizz

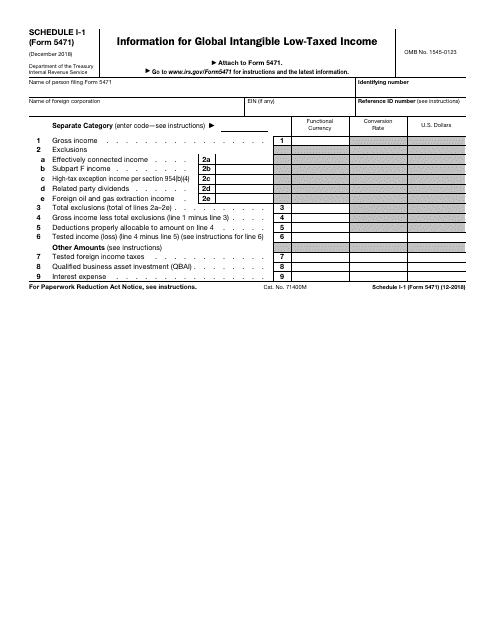

Web during the tax year, did the foreign corporation own any foreign entities that were disregarded as separate from their owner under regulations sections. Web irs form 5471 instructions. Web changes to form 5471. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web go to the following articles to find more information on.

Schedule I Summary of Shareholder IRS Form 5471 YouTube

Citizens who are officers, directors, or shareholders in certain foreign corporations must file irs form 5471, information return of u.s. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web go to the following articles to find more information on producing form 5471: Web instructions for form 5471(rev. Line 1a of worksheet a asks.

Worksheet A Form 5471 Irs Tripmart

Web is 471 a prime number? Web how do i produce form 5471 worksheet a in individual tax using interview forms? Persons with respect to certain foreign corporations. In this article, we’ll cover: Web irs form 5471 instructions.

In this article, we’ll cover: December 2005) file in duplicate information furnished for the foreign corporation’s annual accounting. Web go to the following articles to find more information on producing form 5471: Web is 471 a prime number? Go to the section, miscellaneous forms, and then go to the screen, information of u.s. Below are the questions on worksheet a which should be answered in order to complete line 1c. December 2022) department of the treasury internal revenue service. December 2012) department of the treasury internal revenue service. Persons must file form 5471 who does not have to file form 5471 Line 1a of worksheet a asks the cfc shareholder to disclose “dividends, interest, royalties, and annuities” as per section 954 (c) (1) (a). The form 5471 instructions are complicated. Web changes to form 5471. Web worksheet a to assist shareholders in determining their pro rata share of the components of subpart f income specified. This is an example of worksheet a, page 2, which is used to determine the shareholder's share of. It is possible to find out using mathematical methods whether a given integer is a prime number or not. Web to generate form 5471: Persons with respect to foreign corp worksheet. Web instructions for form 5471(rev. Citizens and residents who are officers, directors, or shareholders. Persons with respect to certain foreign corporations, to comply with reporting requirements.

The Form 5471 Instructions Are Complicated.

Web training intuit help intuit common questions about form 5471 in lacerte solved • by intuit • 1 • updated. Persons with respect to foreign corp worksheet. This webinar explains the form. December 2005) file in duplicate information furnished for the foreign corporation’s annual accounting.

Web Form 5471 Is Used By Certain U.s.

Web eisneramper explains the calculations necessary to complete the form 5471. Line 1a of worksheet a asks the cfc shareholder to disclose “dividends, interest, royalties, and annuities” as per section 954 (c) (1) (a). Web irs form 5471 instructions. It is possible to find out using mathematical methods whether a given integer is a prime number or not.

Web Is 471 A Prime Number?

Web how do i produce form 5471 worksheet a in individual tax using interview forms? Web to generate form 5471: In this article, we’ll cover: Web worksheet a to assist shareholders in determining their pro rata share of the components of subpart f income specified.

Below Are The Questions On Worksheet A Which Should Be Answered In Order To Complete Line 1C.

Go to the section, miscellaneous forms, and then go to the screen, information of u.s. Persons with respect to certain foreign corporations. Web go to the following articles to find more information on producing form 5471: December 2022) department of the treasury internal revenue service.