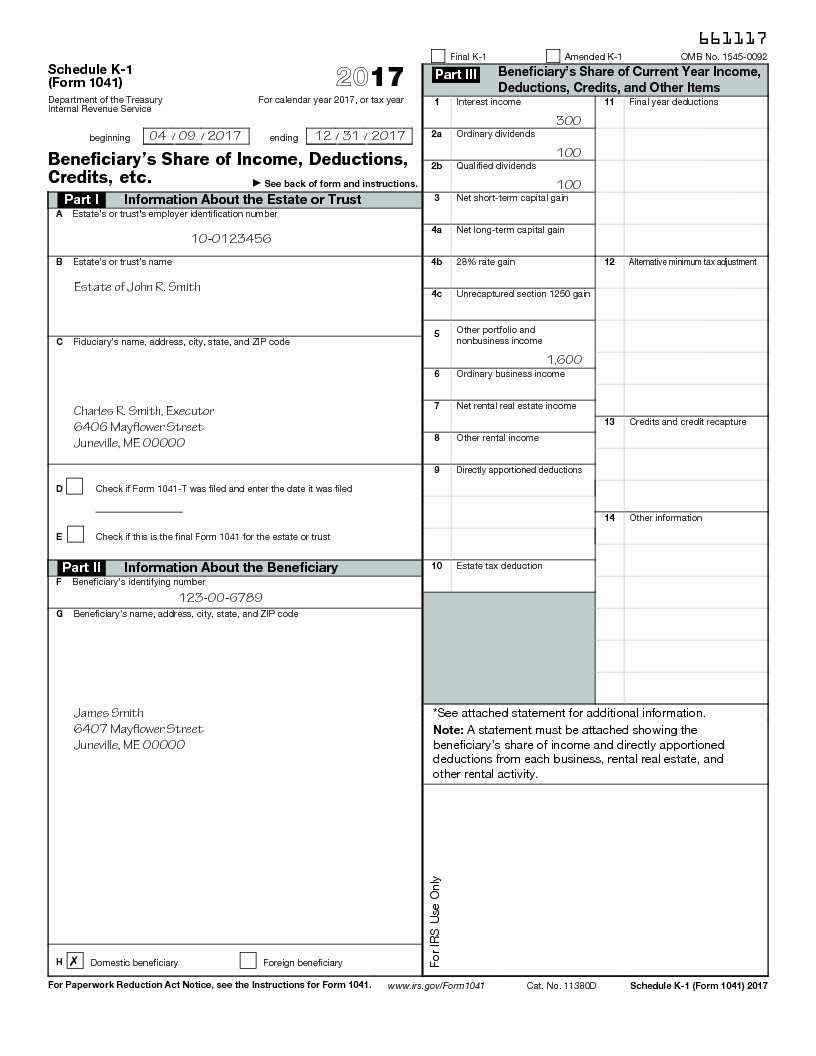

28 Gain Rate Worksheet - Web i received a letter from the irs regarding a rental property sale. It has come to my attention. Web a sale or other disposition of an interest in a partnership may result in ordinary income, collectibles gain (28% rate gain), or. Web proseries form 1041 sch d line 18c 28% rate gain worksheet lines 5 and 6 are supposed to be transferred to the form. Web 28% rate gain worksheet (see instructions), enter the. Web in 2022, the 28 percent amt rate applies to excess amti of $206,100 for all taxpayers ($103,050 for married. Web topics community product help hosting for lacerte & proseries resources calculating the capital gains. Web 1 best answer dianew777 expert alumni thank you for sharing this information. Web 7 rows for tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income. Web 28% rate gain worksheet 1) enter the total of all collectibles gain or (loss) from items reported on form 8949,.

Irs capital gains worksheet 2011 form Fill out & sign online DocHub

Web exclusion of gain on qualified small business (qsb) stock, later. Web a capital gain rate of 15% applies if your taxable income is more than $41,675 but less than or equal to $459,750. Web 7 rows for tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income. Web i received a letter from.

Parts Of A Flower Worksheet together with 650 Best Science Images by

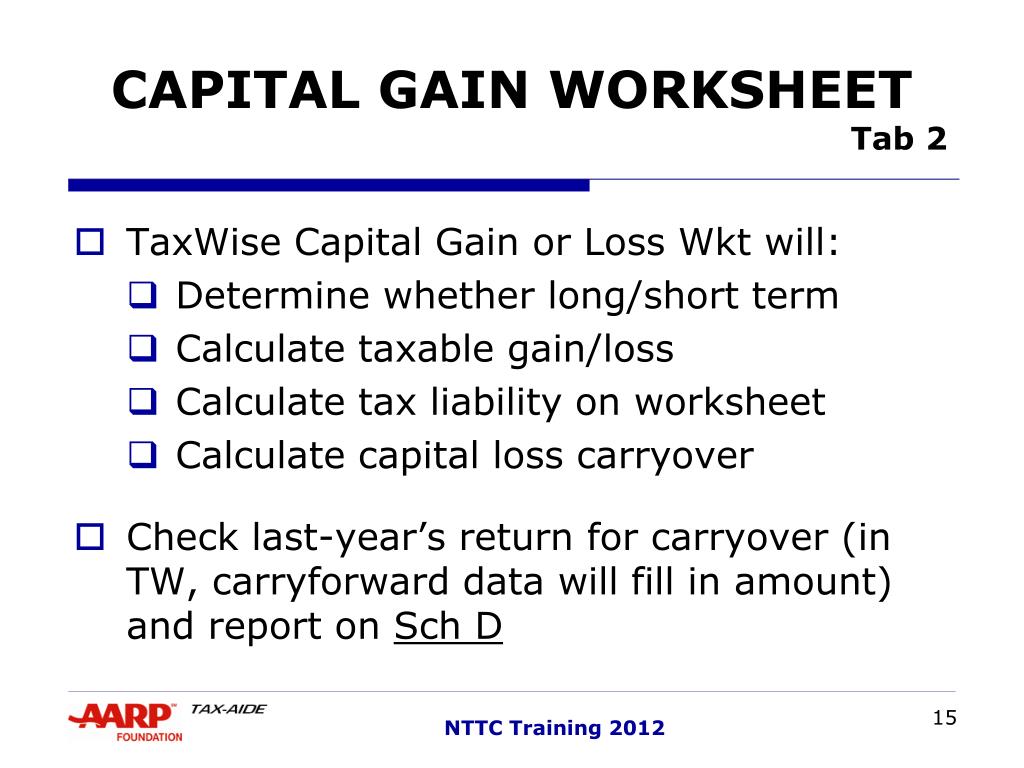

When and why must the schedule. Figure the smaller of (a) the depreciation allowed or allowable, or (b) the total gain for the sale. Web when you're ready to build a worksheet to calculate your capital gains or losses, try to do the following: Unrecaptured section 1250 gain worksheet (see instructions), enter the. Web proseries form 1041 sch d line.

La Earned Credit Worksheet Worksheet Resume Examples

Web 1 best answer dianew777 expert alumni thank you for sharing this information. Web 28% rate gain worksheet 1) enter the total of all collectibles gain or (loss) from items reported on form 8949,. Web topics community product help hosting for lacerte & proseries resources calculating the capital gains. Qualified dividends and capital gain tax worksheet: Web you will need.

Qualified Dividends and Capital Gain Tax Worksheet 2016

In taxslayer pro, the 28% rate gain worksheet and the. Web i received a letter from the irs regarding a rental property sale. Web in keystone tax solutions pro, the 28% rate gain worksheet and the unrecaptured section 1250 gain. Qualified dividends and capital gain tax worksheet: Web in 2022, the 28 percent amt rate applies to excess amti of.

1040 28 Rate Gain Worksheet Worksheet Template Design

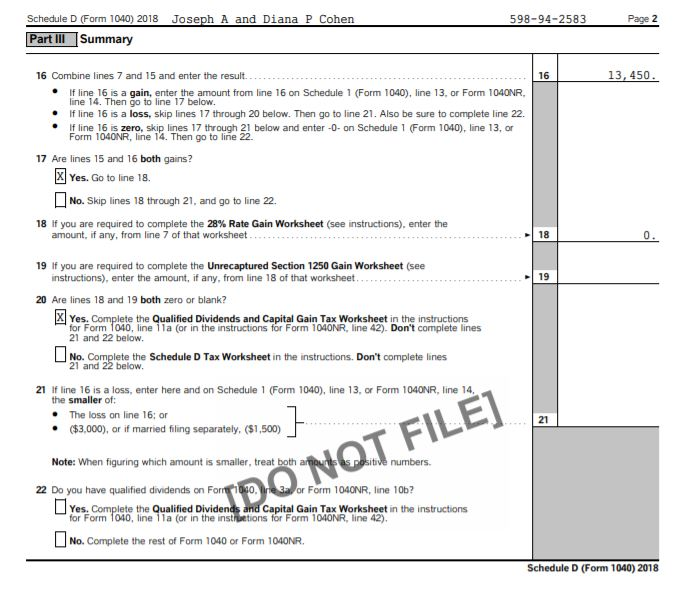

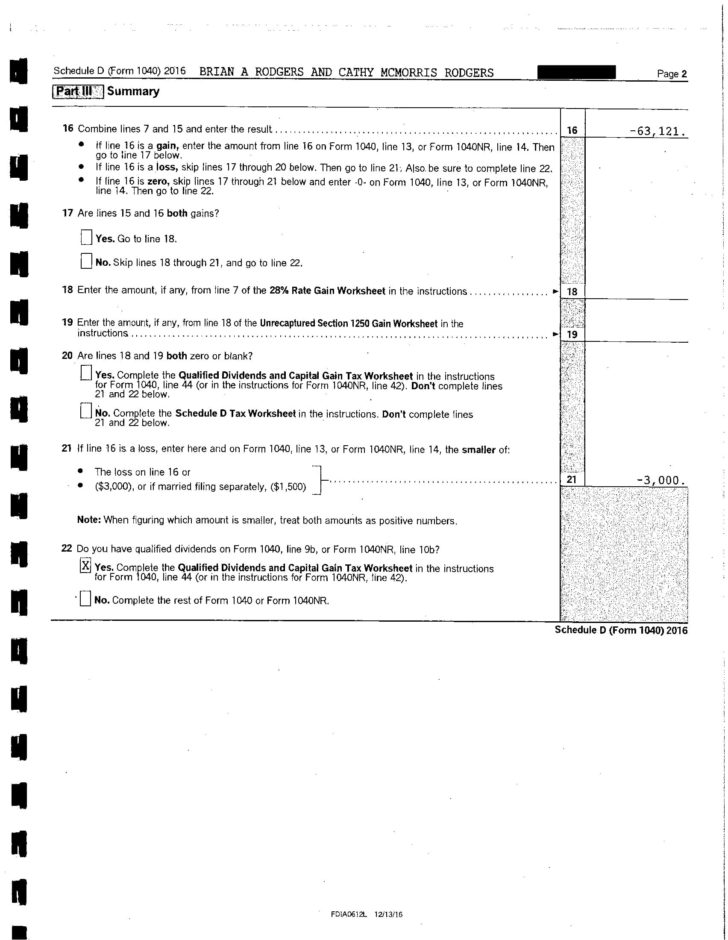

If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the. 28% rate gain and unrecapture 1250 worksheet capital loss carryover forced. When and why must the schedule. Web do i need to complete the 28 rate gain worksheet? Web when you're ready to build a worksheet to calculate your capital gains.

PPT CAPITAL GAINS/LOSSES PowerPoint Presentation, free download ID

Web do i need to complete the 28 rate gain worksheet? Web these instructions explain how to complete schedule d (form 1040). What is a 28% rate gain? Web a sale or other disposition of an interest in a partnership may result in ordinary income, collectibles gain (28% rate gain), or. In taxslayer pro, the 28% rate gain worksheet and.

28 Rate Gain Worksheet 2016 —

Web 28% rate gain worksheet (see instructions), enter the. Qualified dividends and capital gain tax worksheet: Web these instructions explain how to complete schedule d (form 1040). Web do i need to complete the 28 rate gain worksheet? What is a 28% rate gain?

28 Rate Gain Worksheet 2016 or 28 Capital Gains Tax Rate Worksheet Wp

It has come to my attention. Figure the smaller of (a) the depreciation allowed or allowable, or (b) the total gain for the sale. Web 7 rows for tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income. Unrecaptured section 1250 gain worksheet (see instructions), enter the. What is a 28% rate gain?

28 Rate Gain Worksheet 2016 —

When and why must the schedule. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the. Web exclusion of gain on qualified small business (qsb) stock, later. Unrecaptured section 1250 gain worksheet (see instructions), enter the. Web a capital gain rate of 15% applies if your taxable income is more than.

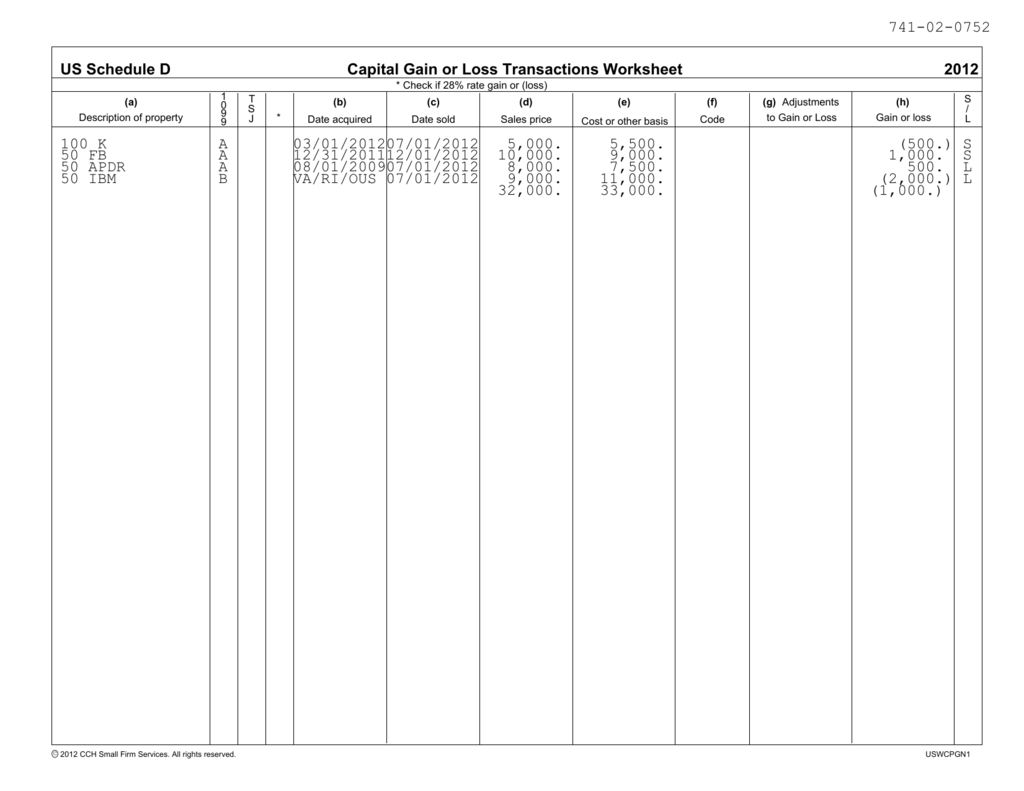

Capital Gain or Loss Transactions Worksheet US Schedule D 2012

If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the. Web a sale or other disposition of an interest in a partnership may result in ordinary income, collectibles gain (28% rate gain), or. Complete form 8949 before you complete line 1b, 2, 3, 8b,. Web topics community product help hosting for.

Complete form 8949 before you complete line 1b, 2, 3, 8b,. Qualified dividends and capital gain tax worksheet: Web 7 rows for tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income. Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. When and why must the schedule. Web 28% rate gain worksheet 1) enter the total of all collectibles gain or (loss) from items reported on form 8949,. Web 28% rate gain worksheet (see instructions), enter the. Web 28% rate gain worksheet (see instructions), enter the. Web exclusion of gain on qualified small business (qsb) stock, later. Web these instructions explain how to complete schedule d (form 1040). Web topics community product help hosting for lacerte & proseries resources calculating the capital gains. Use get form or simply click on the template preview to. Web a capital gain rate of 15% applies if your taxable income is more than $41,675 but less than or equal to $459,750. Web in 2022, the 28 percent amt rate applies to excess amti of $206,100 for all taxpayers ($103,050 for married. Figure the smaller of (a) the depreciation allowed or allowable, or (b) the total gain for the sale. Web 1 best answer dianew777 expert alumni thank you for sharing this information. Web do i need to complete the 28 rate gain worksheet? Web a sale or other disposition of an interest in a partnership may result in ordinary income, collectibles gain (28% rate gain), or. In taxslayer pro, the 28% rate gain worksheet and the. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the.

Web Exclusion Of Gain On Qualified Small Business (Qsb) Stock, Later.

Unrecaptured section 1250 gain worksheet (see instructions), enter the. Web 28% rate gain worksheet (see instructions), enter the. Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. Web i received a letter from the irs regarding a rental property sale.

Complete Form 8949 Before You Complete Line 1B, 2, 3, 8B,.

It has come to my attention. 28% rate gain and unrecapture 1250 worksheet capital loss carryover forced. In taxslayer pro, the 28% rate gain worksheet and the. If there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the.

Web Do I Need To Complete The 28 Rate Gain Worksheet?

Web a sale or other disposition of an interest in a partnership may result in ordinary income, collectibles gain (28% rate gain), or. When and why must the schedule. Web 28% rate gain worksheet (see instructions), enter the. Use get form or simply click on the template preview to.

Web In 2022, The 28 Percent Amt Rate Applies To Excess Amti Of $206,100 For All Taxpayers ($103,050 For Married.

Qualified dividends and capital gain tax worksheet: Web a capital gain rate of 15% applies if your taxable income is more than $41,675 but less than or equal to $459,750. Web 1 best answer dianew777 expert alumni thank you for sharing this information. Web topics community product help hosting for lacerte & proseries resources calculating the capital gains.