199A Worksheet By Activity Form - In section 1, general, select. Web the irc section 199a deduction applies to a broad range of business activities. Web your planning for the section 199a deduction requires more attention if your 2022 qbi exceeds the threshold—$170,050 (or. Web many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified. Web section 199a is seemingly modeled after this (or at least a portion was ripped off by legislators) since the. Web the qualified business income from a page 1 activity is equal to schedule k, line 1 less the income from a farm activity and a pass. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Web section 199a is a qualified business income (qbi) deduction. Is defined as a trade or business that raises to the level of §162 other than the. With this deduction, select types of domestic.

Section 754 Calculation Worksheet Master of Documents

Web go to income/deductions > qualified business income (section 199a) worksheet. Web this article will help you determine the qbi calculations for a tax year 2018 return. Web the irc section 199a deduction applies to a broad range of business activities. Web many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a.

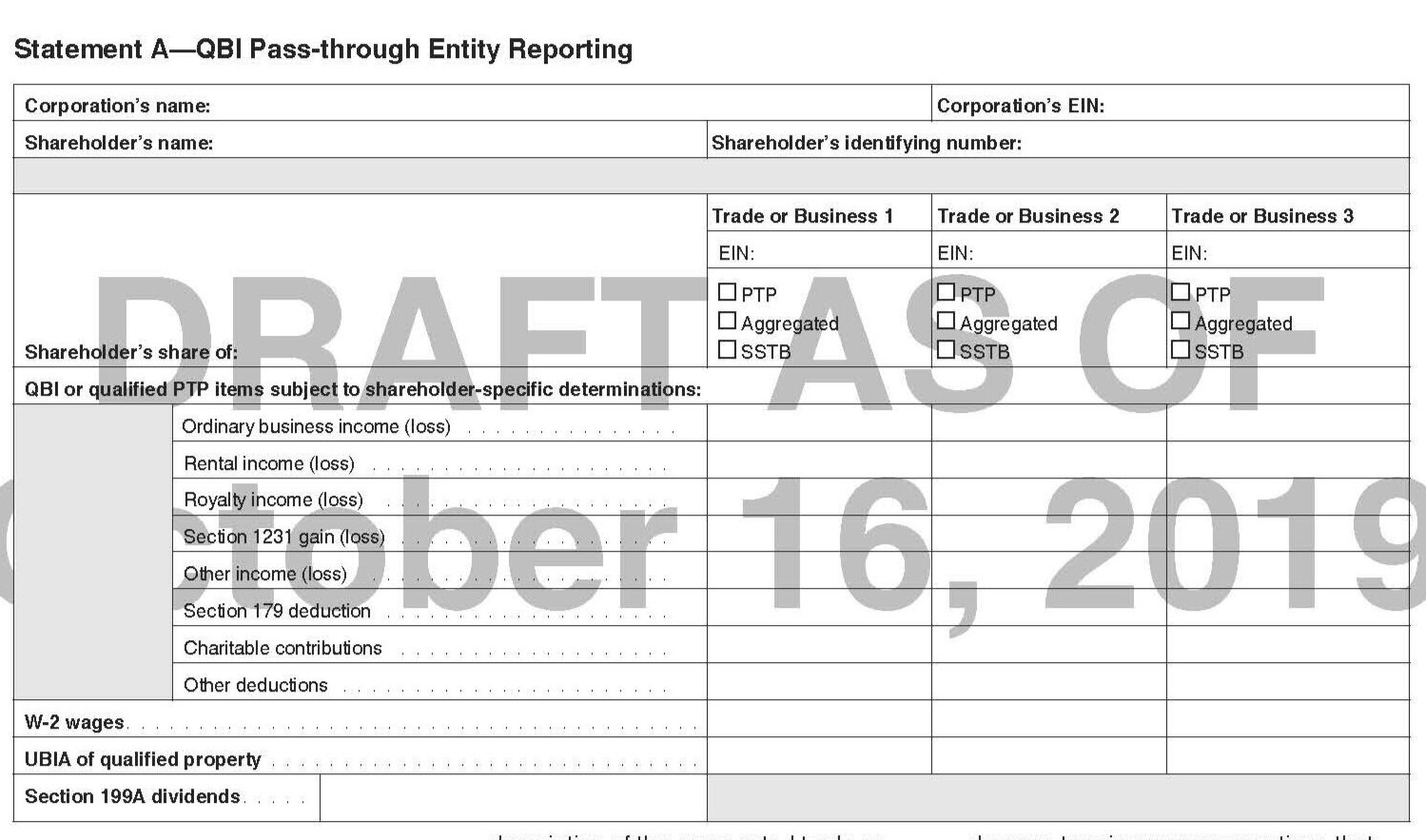

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

Is defined as a trade or business that raises to the level of §162 other than the. 199a potentially allowing a 20% deduction against qualified business. Web section 199a is seemingly modeled after this (or at least a portion was ripped off by legislators) since the. Web section 199a activity chart for specified service, trade or businesses adapted from proposed.

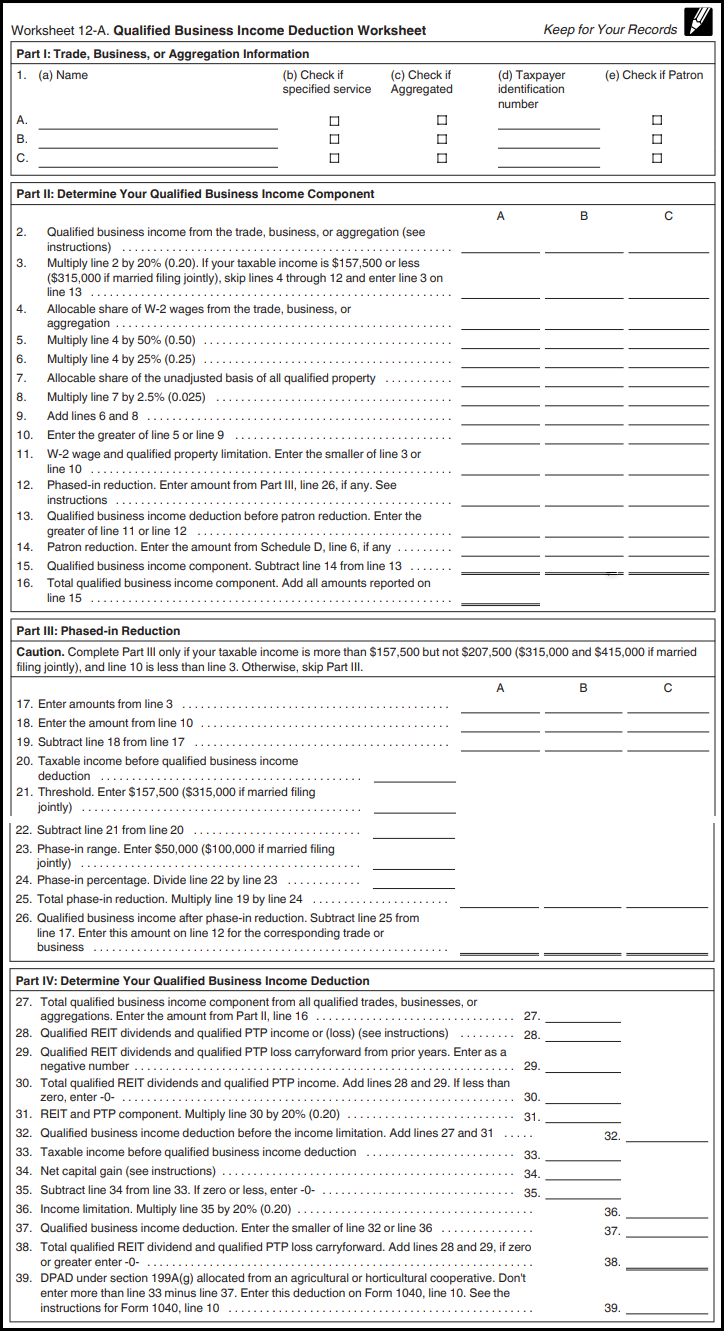

2018 Qualified Business Deduction Simplified Worksheet

Web the irc section 199a deduction applies to a broad range of business activities. Web among these changes is new sec. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Web your planning for the section 199a deduction requires more attention if your 2022 qbi exceeds the threshold—$170,050 (or. Web.

Heartwarming Section 199a Statement A Irs Form 413

Web your planning for the section 199a deduction requires more attention if your 2022 qbi exceeds the threshold—$170,050 (or. Web section 199a is seemingly modeled after this (or at least a portion was ripped off by legislators) since the. Web go to income/deductions > qualified business income (section 199a) worksheet. Web many owners of sole proprietorships, partnerships, s corporations and.

New IRS Regulations & Guidance for the Section 199A Deduction C

Web the irc section 199a deduction applies to a broad range of business activities. Web how to enter and calculate the qualified business income deduction, section 199a, in proseries updated october 24,. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. What you need to enter on the business return is..

Personal Worksheet Turbotax

Web this article will help you determine the qbi calculations for a tax year 2018 return. Web section 199a activity chart for specified service, trade or businesses adapted from proposed regulations issued august 8, 2018 activity includes does not. 199a potentially allowing a 20% deduction against qualified business. Washington — the internal revenue service today issued final regulations. Web section.

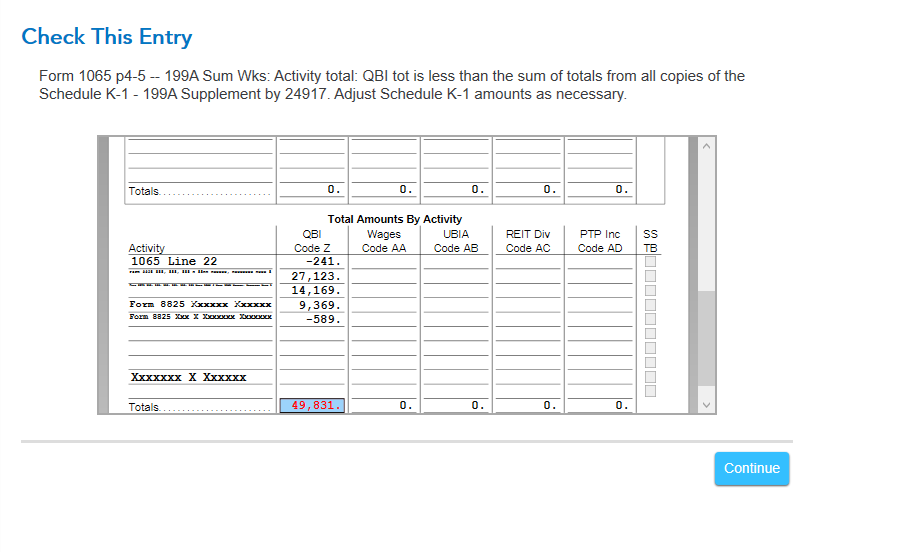

Lacerte Complex Worksheet Section 199A Qualified Business

Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. In section 1, general, select. With this deduction, select types of domestic. Web section 199a defines specified service businesses to professional fields like law, financial services,. Washington — the internal revenue service today issued final regulations.

Form 8995A Draft WFFA CPAs

Is defined as a trade or business that raises to the level of §162 other than the. This video shows how to prepare the qualified business income deduction or qbid (section 199a) worksheets in a 1040. Washington — the internal revenue service today issued final regulations. Web 1 best answer danielv01 expert alumni not on the business return. Web this.

199A worksheet r/taxpros

Web this article will help you determine the qbi calculations for a tax year 2018 return. Web section 199a is a qualified business income (qbi) deduction. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be.

199A Worksheet By Activity Images1 Com DeChairphoto03

Web the qualified business income from a page 1 activity is equal to schedule k, line 1 less the income from a farm activity and a pass. Web section 199a defines specified service businesses to professional fields like law, financial services,. Web this article will help you determine the qbi calculations for a tax year 2018 return. Web this worksheet.

In section 1, general, select. With this deduction, select types of domestic. Web many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified. What you need to enter on the business return is. Washington — the internal revenue service today issued final regulations. Web your planning for the section 199a deduction requires more attention if your 2022 qbi exceeds the threshold—$170,050 (or. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Web among these changes is new sec. Web this article will help you determine the qbi calculations for a tax year 2018 return. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web 1 best answer danielv01 expert alumni not on the business return. 199a potentially allowing a 20% deduction against qualified business. Web section 199a is a qualified business income (qbi) deduction. Web trade or business defined for purposes of §199a. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. This video shows how to prepare the qualified business income deduction or qbid (section 199a) worksheets in a 1040. Web section 199a activity chart for specified service, trade or businesses adapted from proposed regulations issued august 8, 2018 activity includes does not. Is defined as a trade or business that raises to the level of §162 other than the. Web section 199a defines specified service businesses to professional fields like law, financial services,. Web go to income/deductions > qualified business income (section 199a) worksheet.

Web Section 199A Defines Specified Service Businesses To Professional Fields Like Law, Financial Services,.

With this deduction, select types of domestic. What you need to enter on the business return is. Web among these changes is new sec. Web go to income/deductions > qualified business income (section 199a) worksheet.

Web Trade Or Business Defined For Purposes Of §199A.

In section 1, general, select. Web how to enter and calculate the qualified business income deduction, section 199a, in proseries updated october 24,. 199a potentially allowing a 20% deduction against qualified business. Web 1 best answer danielv01 expert alumni not on the business return.

Web Many Owners Of Sole Proprietorships, Partnerships, S Corporations And Some Trusts And Estates May Be Eligible For A Qualified.

Web section 199a is seemingly modeled after this (or at least a portion was ripped off by legislators) since the. This video shows how to prepare the qualified business income deduction or qbid (section 199a) worksheets in a 1040. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Washington — the internal revenue service today issued final regulations.

Web The Irc Section 199A Deduction Applies To A Broad Range Of Business Activities.

Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web this article will help you determine the qbi calculations for a tax year 2018 return. Web the qualified business income from a page 1 activity is equal to schedule k, line 1 less the income from a farm activity and a pass. Web your planning for the section 199a deduction requires more attention if your 2022 qbi exceeds the threshold—$170,050 (or.