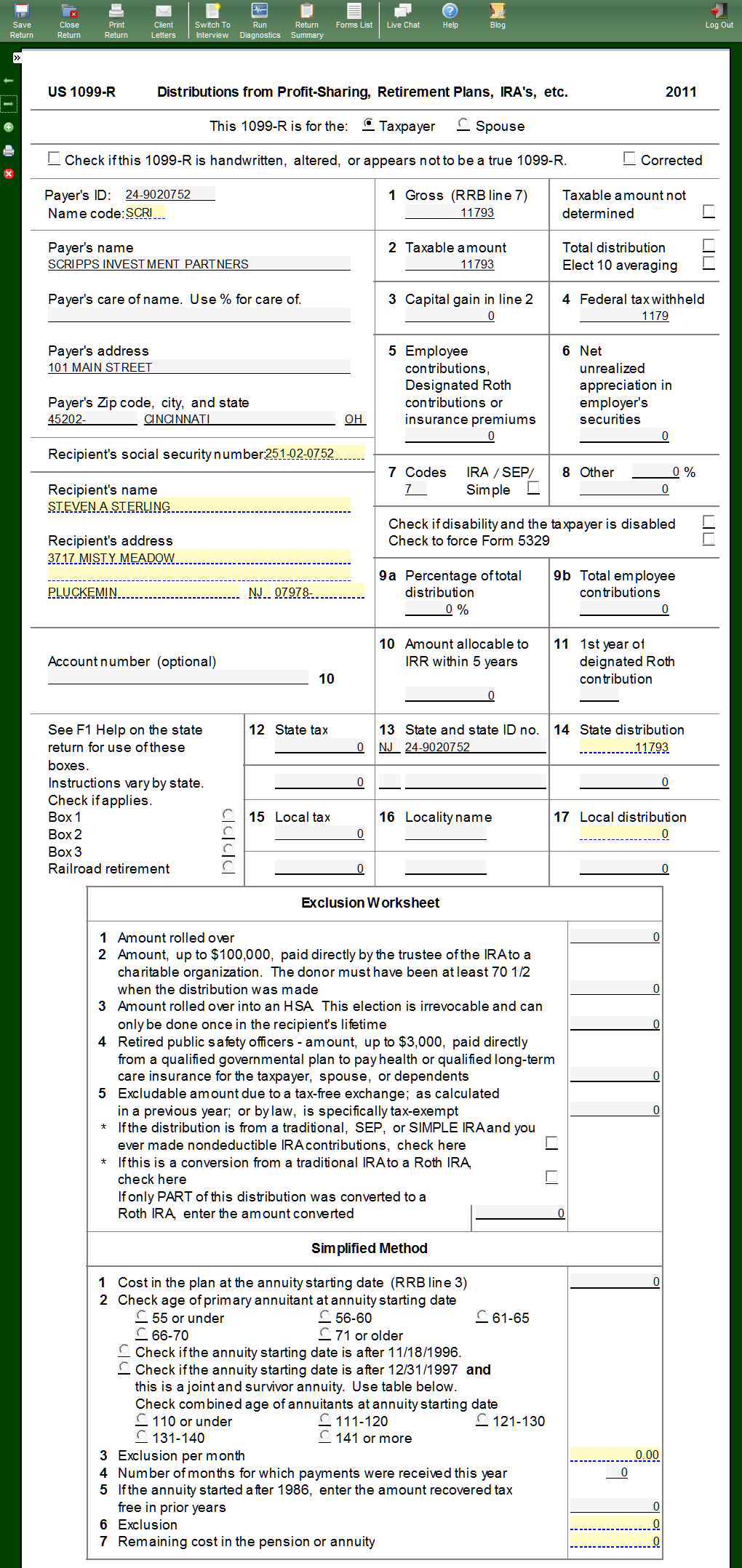

1099 R Simplified Method Worksheet - Generally, for a joint and survivor annuity, use the combined ages to. Complete worksheet a near the end of this publication to figure your taxable annuity for 2022. Web simplified general rule worksheet: Plan cost at annuity start date: Be sure to keep the. Yes, the taxable annuity amount was used as the. Web if the taxable amount is not indicated, advanced certified volunteers must calculate the taxable portion using the simplified. Get ready for this year\'s tax season quickly and safely with. Web taxable amount may have to be determined using simplified method. The payments you receive next year will generally be fully taxable enter the total.

1099 R Simplified Method Worksheet

If you receive pension or annuity payments from a qualified plan and you aren't required to use the general rule, you must use the simplified. Web 1 best answer macuser_22 level 15 @willcastle43633 wrote: The payments you receive next year will generally be fully taxable enter the total. Qualified plans and section 403(b) plans. Turbo tax will not allow the.

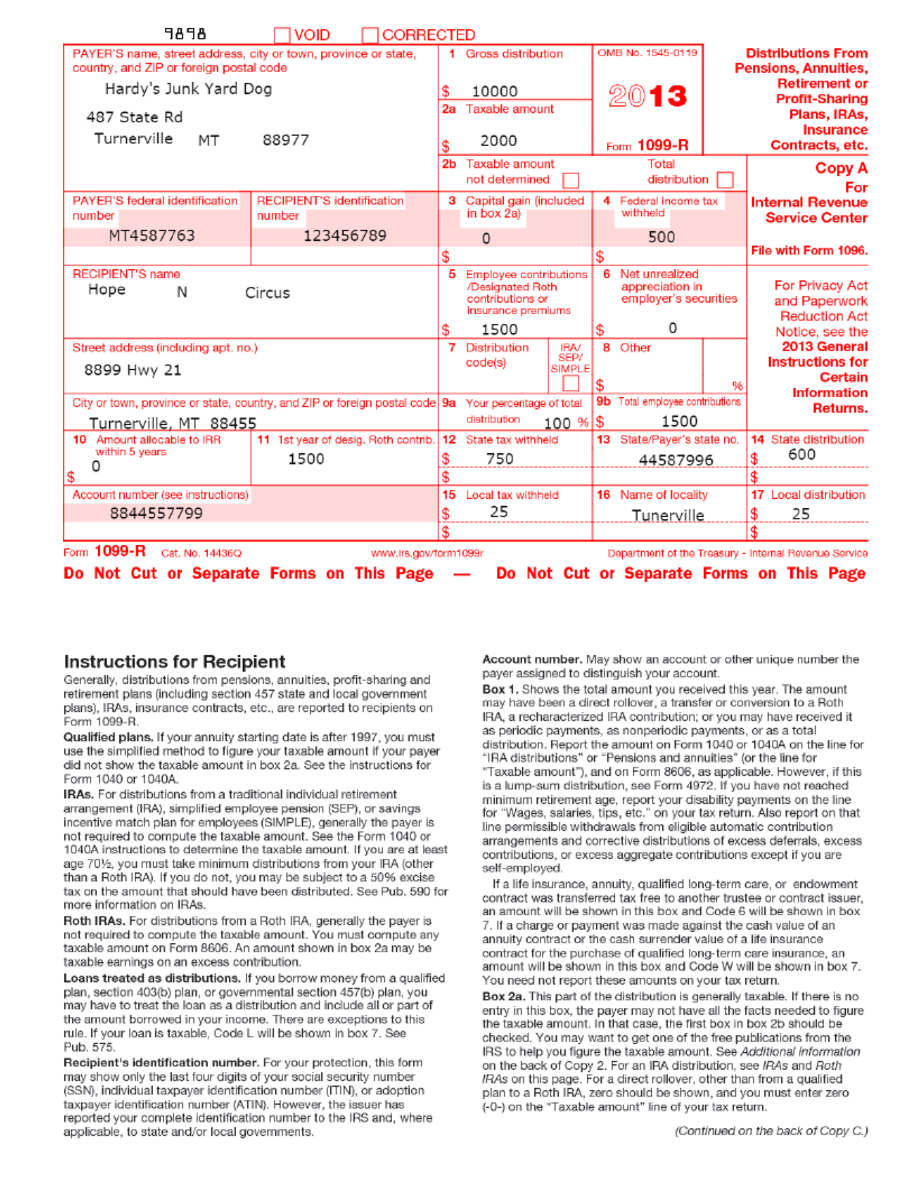

How to Calculate Taxable Amount on a 1099R for Life Insurance

Web taxable amount may have to be determined using simplified method. Yes, the taxable annuity amount was used as the. Web if the taxable amount is not indicated, advanced certified volunteers must calculate the taxable portion using the simplified. Web how to use the simplified method. Generally, for a joint and survivor annuity, use the combined ages to.

1099 R Simplified Method Worksheet

Web if the taxable amount is not indicated, advanced certified volunteers must calculate the taxable portion using the simplified. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the. Turbo tax will not allow the 1040 to be electronically filed without the. The payments you receive next year will generally.

1099 R Worksheet

Web 1 best answer macuser_22 level 15 @willcastle43633 wrote: Complete worksheet a near the end of this publication to figure your taxable annuity for 2022. Web simplified general rule worksheet: Be sure to keep the. Get ready for this year\'s tax season quickly and safely with.

1099 R Simplified Method Worksheet

Generally, for a joint and survivor annuity, use the combined ages to. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the. Yes, the taxable annuity amount was used as the. Web simplified general rule worksheet: Turbo tax will not allow the 1040 to be electronically filed without the.

1099 R Simplified Method Worksheet

If you receive pension or annuity payments from a qualified plan and you aren't required to use the general rule, you must use the simplified. Complete worksheet a near the end of this publication to figure your taxable annuity for 2022. Be sure to keep the. Web simplified general rule worksheet: Get ready for this year\'s tax season quickly and.

1099 R Worksheet

Qualified plans and section 403(b) plans. The payments you receive next year will generally be fully taxable enter the total. Get ready for this year\'s tax season quickly and safely with. Complete worksheet a near the end of this publication to figure your taxable annuity for 2022. If you receive pension or annuity payments from a qualified plan and you.

1099 R Simplified Method Worksheet

Plan cost at annuity start date: Web taxable amount may have to be determined using simplified method. If you receive pension or annuity payments from a qualified plan and you aren't required to use the general rule, you must use the simplified. Get ready for this year\'s tax season quickly and safely with. Generally, for a joint and survivor annuity,.

1099 R Worksheet

Turbo tax will not allow the 1040 to be electronically filed without the. Yes, the taxable annuity amount was used as the. Plan cost at annuity start date: Web taxable amount may have to be determined using simplified method. Web how to use the simplified method.

Simplified Method Worksheet 2020 1099r Unitary

Be sure to keep the. Web simplified general rule worksheet: Web taxable amount may have to be determined using simplified method. Yes, the taxable annuity amount was used as the. Web how to use the simplified method.

Complete worksheet a near the end of this publication to figure your taxable annuity for 2022. Qualified plans and section 403(b) plans. Web 1 best answer macuser_22 level 15 @willcastle43633 wrote: Be sure to keep the. Get ready for this year\'s tax season quickly and safely with. Yes, the taxable annuity amount was used as the. Web taxable amount may have to be determined using simplified method. The payments you receive next year will generally be fully taxable enter the total. Web how to use the simplified method. Web if the taxable amount is not indicated, advanced certified volunteers must calculate the taxable portion using the simplified. Generally, for a joint and survivor annuity, use the combined ages to. Turbo tax will not allow the 1040 to be electronically filed without the. If you receive pension or annuity payments from a qualified plan and you aren't required to use the general rule, you must use the simplified. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the. Web simplified general rule worksheet: Plan cost at annuity start date:

Complete Worksheet A Near The End Of This Publication To Figure Your Taxable Annuity For 2022.

Yes, the taxable annuity amount was used as the. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the. Generally, for a joint and survivor annuity, use the combined ages to. If you receive pension or annuity payments from a qualified plan and you aren't required to use the general rule, you must use the simplified.

Web Simplified General Rule Worksheet:

The payments you receive next year will generally be fully taxable enter the total. Get ready for this year\'s tax season quickly and safely with. Web 1 best answer macuser_22 level 15 @willcastle43633 wrote: Web if the taxable amount is not indicated, advanced certified volunteers must calculate the taxable portion using the simplified.

Qualified Plans And Section 403(B) Plans.

Web how to use the simplified method. Turbo tax will not allow the 1040 to be electronically filed without the. Web taxable amount may have to be determined using simplified method. Be sure to keep the.