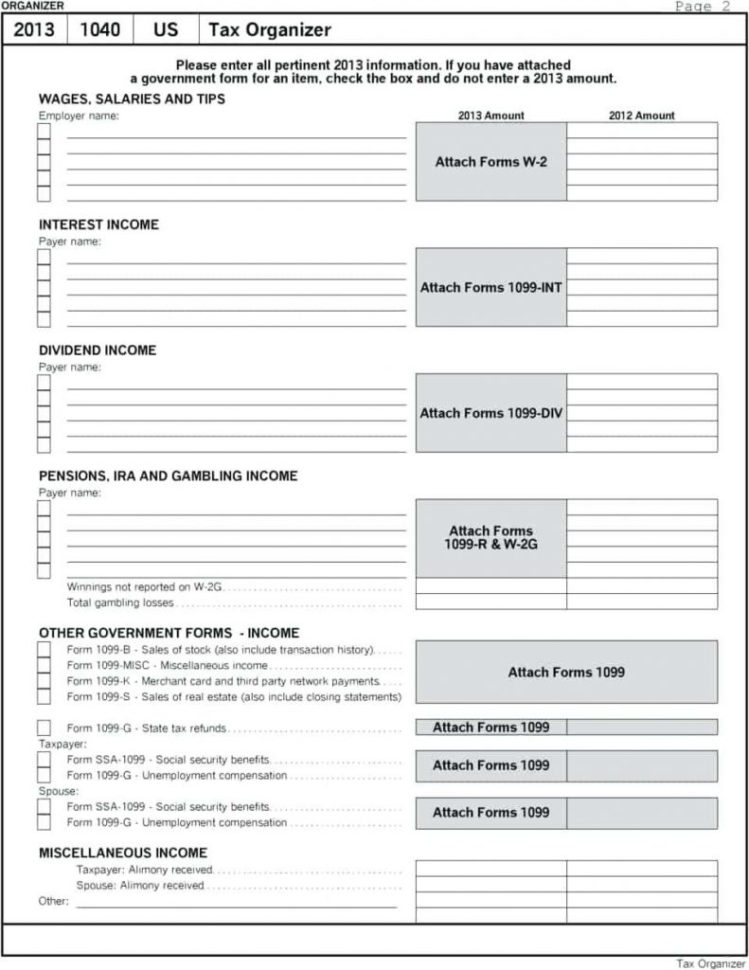

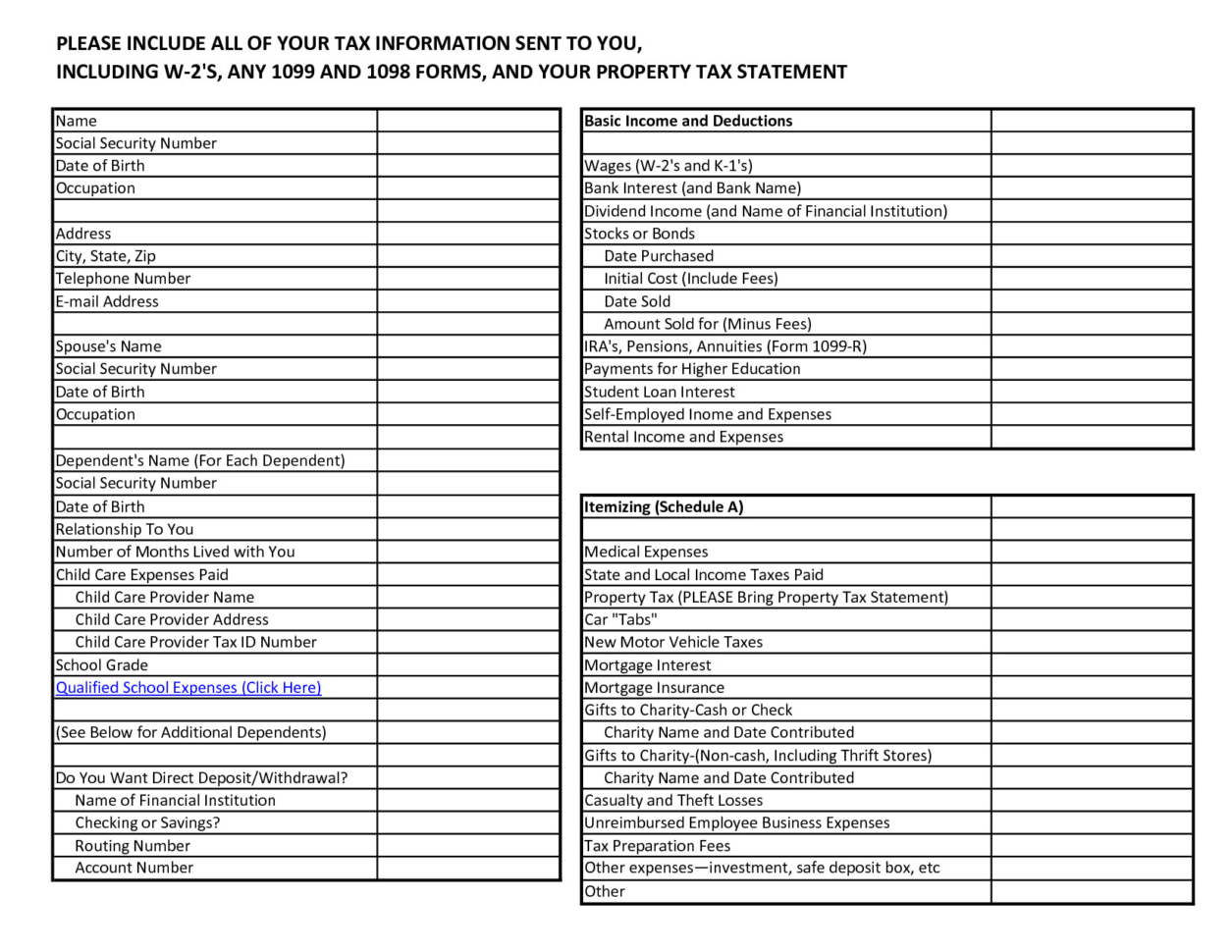

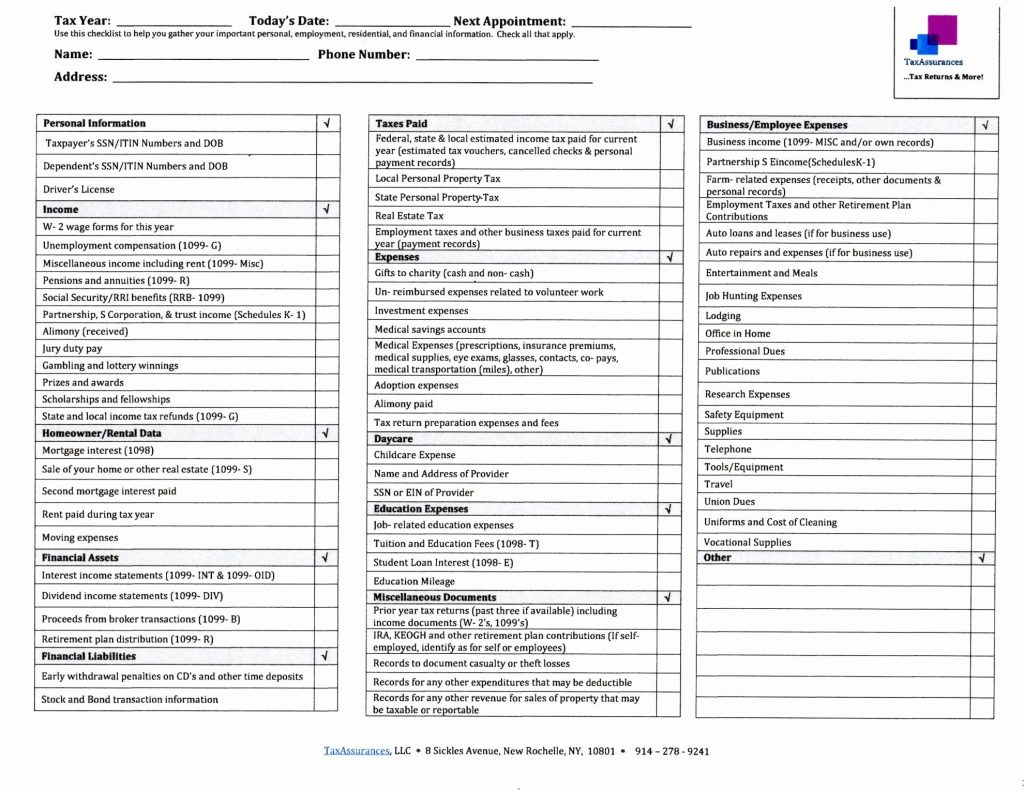

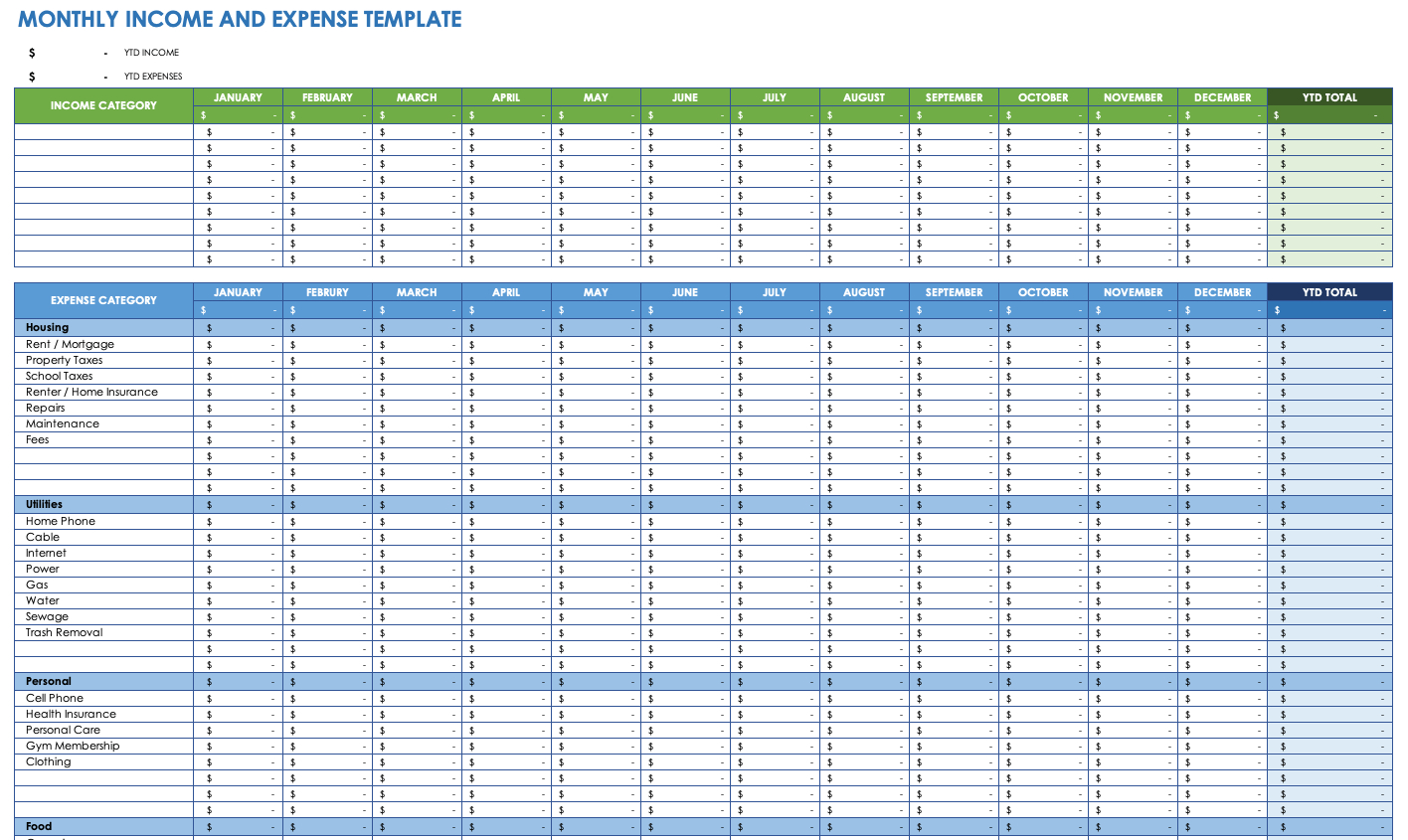

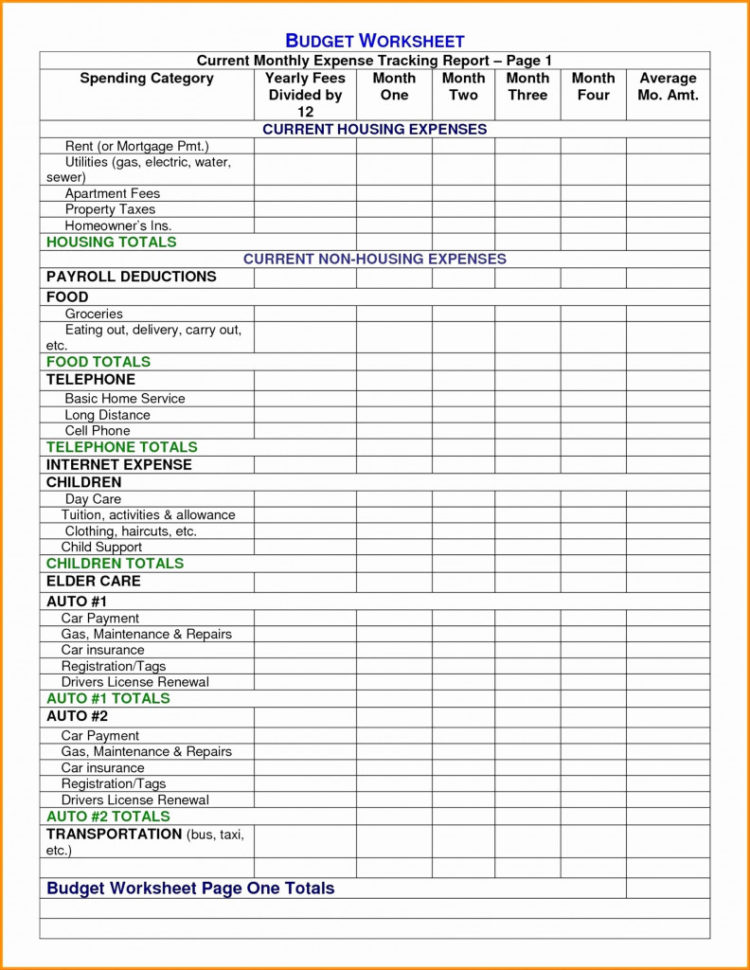

1099 Expenses Worksheet - Scan your paper receipts and digitize them; Get tax form (1099/1042s) update direct deposit. Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; Keep track of your 1099 digital receipts; Web what expenses can i deduct as a 1099 contractor? Web online fillable form. Use an expense tracker app. Web here is how to calculate your quarterly taxes: Web at least $600 in: Web know what expenses are qualified as 1099 expenses by the irs;

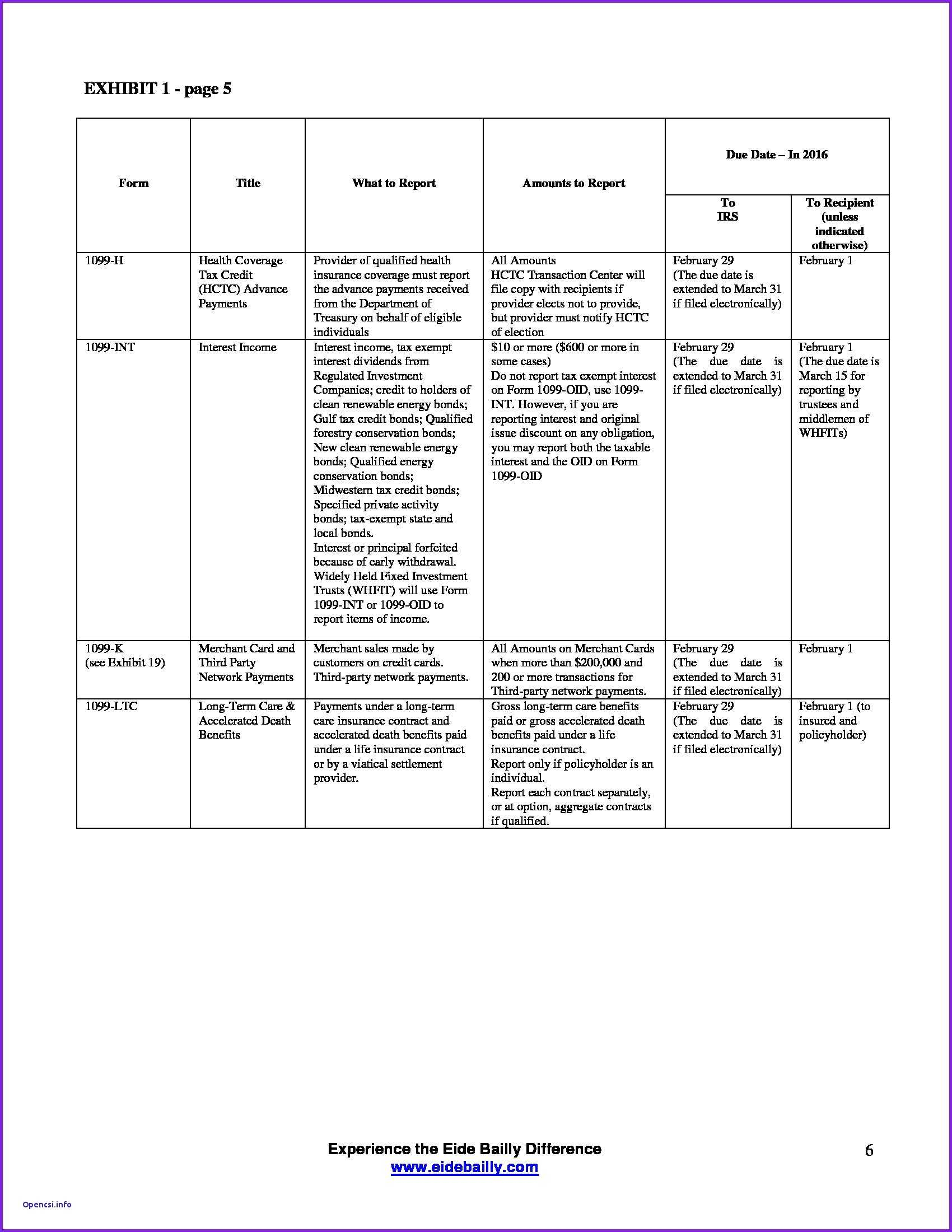

TSP 2020 Form 1099R Statements Should Be Examined Carefully

Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right. Web to calculate the simplified home office deduction you simply multiply the square footage of your home used for business by. Web an independent contractor expenses spreadsheet is a table—often created through microsoft excel or google. Scan your paper receipts.

1099 Spreadsheet Google Spreadshee 1099 expense spreadsheet. 1099

Web what expenses can i deduct as a 1099 contractor? Get tax form (1099/1042s) update direct deposit. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right. Keep track of your 1099 digital receipts; Use an expense tracker app.

1099 Expense Spreadsheet Spreadsheet Downloa 1099 expense spreadsheet.

Web what expenses can i deduct as a 1099 contractor? Web 4 simple tips for tracking business expenses. 1099 part time work expenses; The standard mileage method the standard mileage rate lumps ordinary expenses together and allows you to deduct a single price per. Use an expense tracker app.

1099 Expense Spreadsheet Spreadsheet Downloa 1099 expense spreadsheet.

Scan your paper receipts and digitize them; Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Get tax form (1099/1042s) update direct deposit. Web an independent contractor expenses spreadsheet is a table—often created through microsoft excel or google. Web also, use schedule c to report (a) wages.

1099 Expense Spreadsheet Spreadsheet Downloa 1099 expense spreadsheet.

(b) income and deductions of certain. 1099 part time work expenses; Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; Use a 1099 spreadsheet template (excel or google sheets) standard 1099 deduction expenses; Web here is how to calculate your quarterly taxes:

1099 Invoice Template New 1099 Contractor Invoice Template Seven Things

Web generally, report this amount on the “other income” line of schedule 1 (form 1040) and identify the payment. Web what expenses can i deduct as a 1099 contractor? Medical and health care payments. (b) income and deductions of certain. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms.

Free 1099 Template Excel (With StepByStep Instructions!)

Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right. Web an independent contractor expenses spreadsheet is a table—often created through microsoft excel or google. Web at least $600 in: Web know what expenses are qualified as 1099 expenses by the irs; The standard mileage method the standard mileage rate.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web here is the top 1099 self employment tax deductions list, along with additional 1099 deducations that you. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right..

1099 Expense Spreadsheet Spreadsheet Downloa 1099 expense spreadsheet.

Web at least $600 in: (b) income and deductions of certain. The standard mileage method the standard mileage rate lumps ordinary expenses together and allows you to deduct a single price per. Web online fillable form. Web 4 simple tips for tracking business expenses.

1099 Expense Spreadsheet Spreadsheet Downloa 1099 expense spreadsheet.

Use a 1099 spreadsheet template (excel or google sheets) standard 1099 deduction expenses; Get tax form (1099/1042s) update direct deposit. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms.

Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. The standard mileage method the standard mileage rate lumps ordinary expenses together and allows you to deduct a single price per. Web to calculate the simplified home office deduction you simply multiply the square footage of your home used for business by. Web know what expenses are qualified as 1099 expenses by the irs; Web an independent contractor expenses spreadsheet is a table—often created through microsoft excel or google. Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; Use an expense tracker app. Web here is how to calculate your quarterly taxes: Keep track of your 1099 digital receipts; Web here is the top 1099 self employment tax deductions list, along with additional 1099 deducations that you. (b) income and deductions of certain. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right. Web what expenses can i deduct as a 1099 contractor? Use a 1099 spreadsheet template (excel or google sheets) standard 1099 deduction expenses; Medical and health care payments. Web generally, report this amount on the “other income” line of schedule 1 (form 1040) and identify the payment. Scan your paper receipts and digitize them; 1099 part time work expenses; Web online fillable form. Web 4 simple tips for tracking business expenses.

Medical And Health Care Payments.

Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right. The standard mileage method the standard mileage rate lumps ordinary expenses together and allows you to deduct a single price per. Web online fillable form. Web know what expenses are qualified as 1099 expenses by the irs;

Use A 1099 Spreadsheet Template (Excel Or Google Sheets) Standard 1099 Deduction Expenses;

Web here is the top 1099 self employment tax deductions list, along with additional 1099 deducations that you. Web an independent contractor expenses spreadsheet is a table—often created through microsoft excel or google. Get tax form (1099/1042s) update direct deposit. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules.

(B) Income And Deductions Of Certain.

Web here is how to calculate your quarterly taxes: Web to calculate the simplified home office deduction you simply multiply the square footage of your home used for business by. 1099 part time work expenses; Web at least $600 in:

Web Also, Use Schedule C To Report (A) Wages And Expenses You Had As A Statutory Employee;

Scan your paper receipts and digitize them; Keep track of your 1099 digital receipts; Web what expenses can i deduct as a 1099 contractor? Web 4 simple tips for tracking business expenses.