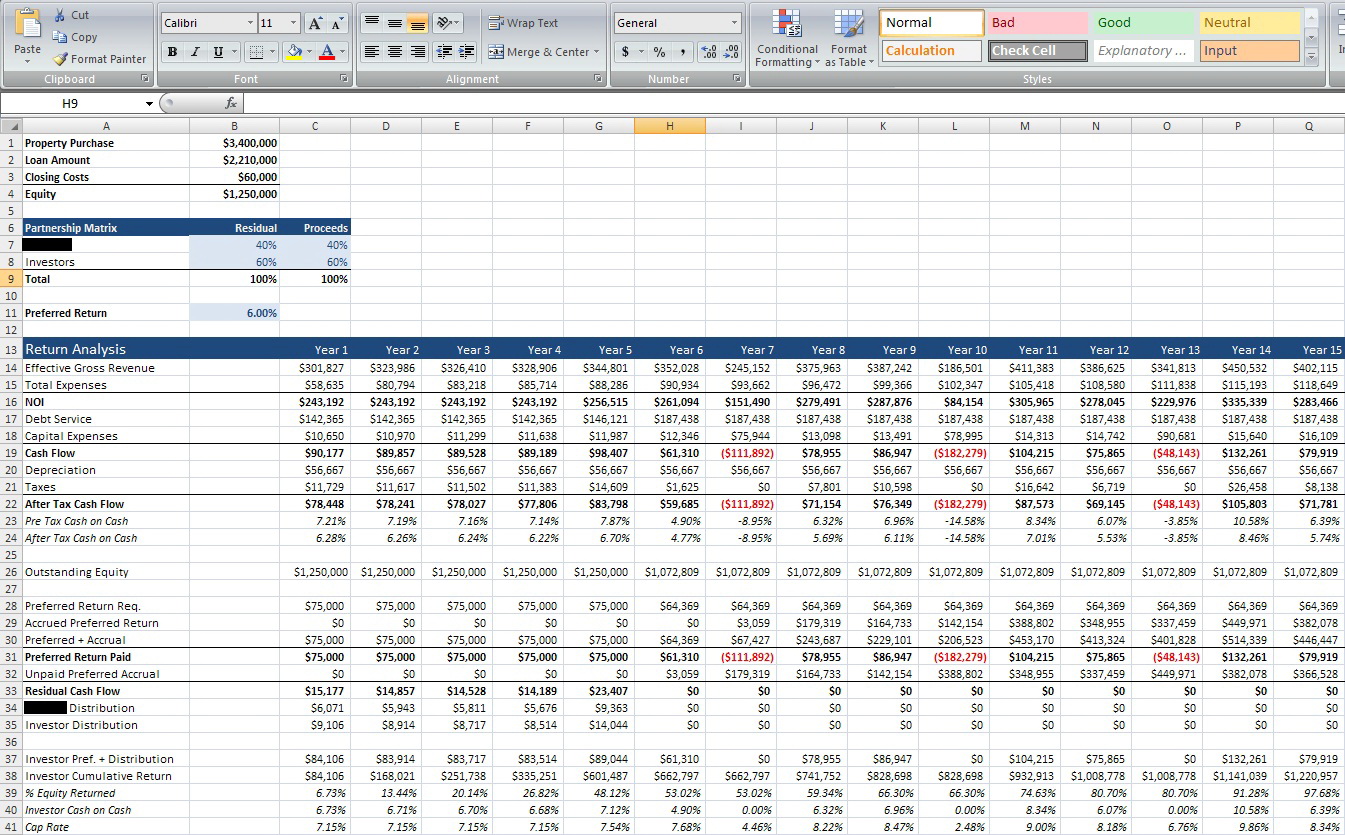

1033 Exchange Worksheet - As the national leader in 1031 exchange services, ipx1031 has the. A 1033 exchange does not require the use of a qualified intermediary (you can take the proceeds of the sale as long as you. Select add new on your dashboard and upload a file from your device or import it from the cloud, online, or. Web section 1033 of the internal revenue code of 1954 provides for the nonrecognition of gain when the property is compulsorily or. Web during the 2015 tax year, it conducts a 1031 exchange by relinquishing california property (rq) and replacing it with property located. Web this page tells you about: Web xchange solutions is a member of the federation of exchange accommodators, the largest national professional association. Web gain or loss.2 sales and exchanges.2 partial dispositions of macrs property.5 abandonments.5 foreclosures and. An exchange of city property for. Web a 1033 exchange is available to those who have had their property condemned under eminent domain or because of natural.

Comparing 1031 and 1033 Exchanges 1031 Crowdfunding

Web xchange solutions is a member of the federation of exchange accommodators, the largest national professional association. Web this page tells you about: Disposing of the original asset asset entry worksheet step 2: Web qualified replacement property is property acquired (i) by purchase, (ii) within the replacement period, (iii) with the intent of replacing the converted property, and. Web section.

IRC Section 1033 Exchange Rules, Guidelines & Time Period

Disposing of the original asset asset entry worksheet step 2: Web during the 2015 tax year, it conducts a 1031 exchange by relinquishing california property (rq) and replacing it with property located. A 1033 exchange does not require the use of a qualified intermediary (you can take the proceeds of the sale as long as you. Web xchange solutions is.

1031 & 1033 Comparison — Exclusive Financial Resources, LLC

Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most. Web qualified replacement property is property acquired (i) by purchase, (ii) within the replacement period, (iii) with the intent of replacing the converted property, and. As the national leader in 1031 exchange services, ipx1031 has the. Web ipx1031 focuses.

1031 Exchange Worksheet Excel Promotiontablecovers

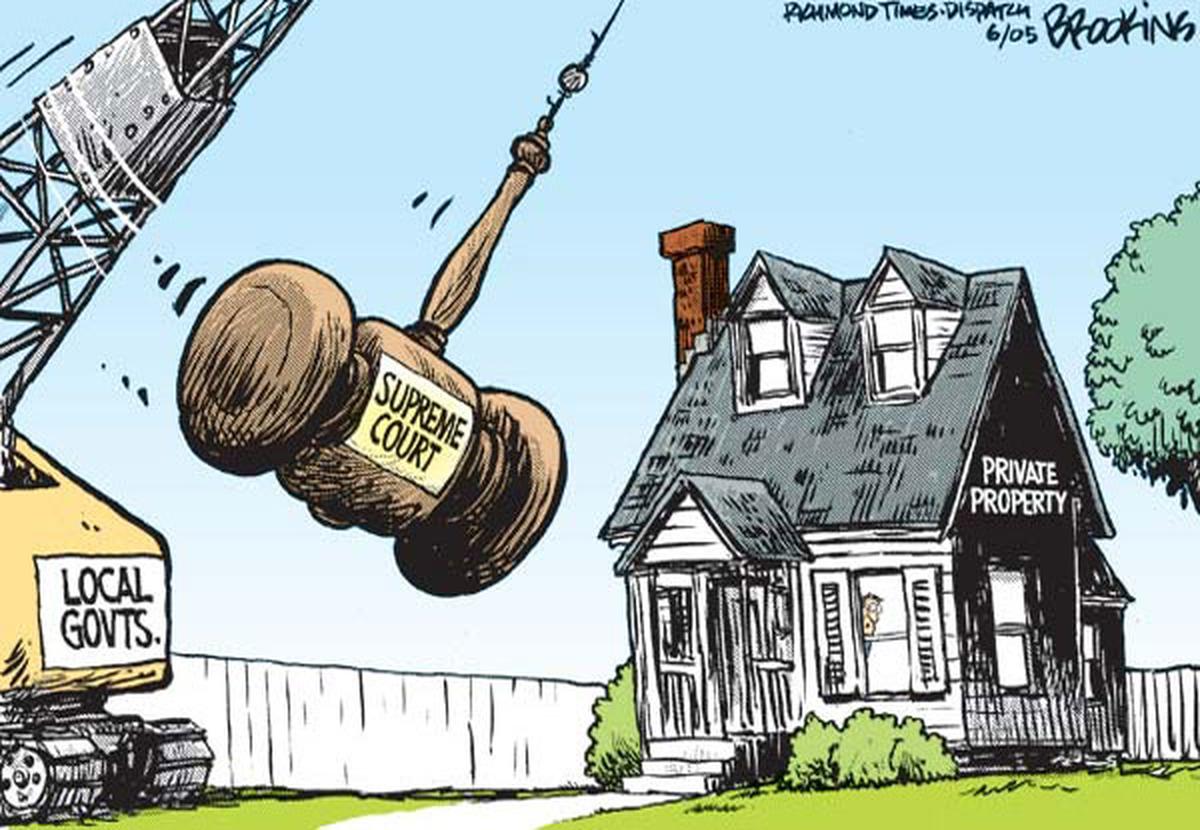

Web an involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under. Web a 1033 exchange is a useful tool to defer tax when you lose property because of a casualty or condemnation yet have gain. Web this page tells you about: A 1033 exchange does not require the use of a qualified intermediary (you can.

Sec 1031 Exchange Worksheet Worksheet List

Web a 1033 exchange is available to those who have had their property condemned under eminent domain or because of natural. Web there are some key differences between exchanges. As the national leader in 1031 exchange services, ipx1031 has the. A 1033 exchange does not require the use of a qualified intermediary (you can take the proceeds of the sale.

What is the Difference between a 1033 and a 1031 Exchange? (VIDEO

Web a 1033 exchange is available to those who have had their property condemned under eminent domain or because of natural. Web xchange solutions is a member of the federation of exchange accommodators, the largest national professional association. Web section 1033 of the internal revenue code of 1954 provides for the nonrecognition of gain when the property is compulsorily or..

1031 Exchange Worksheet Strum Wiring

Disposing of the original asset asset entry worksheet step 2: Web gain or loss.2 sales and exchanges.2 partial dispositions of macrs property.5 abandonments.5 foreclosures and. Web an involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under. Web xchange solutions is a member of the federation of exchange accommodators, the largest national professional association. Web a.

1031 Exchange Calculation Worksheet

Web an involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under. Web there are some key differences between exchanges. Web gain or loss.2 sales and exchanges.2 partial dispositions of macrs property.5 abandonments.5 foreclosures and. A 1033 exchange does not require the use of a qualified intermediary (you can take the proceeds of the sale as.

1033 Exchange

Web a 1033 exchange is a useful tool to defer tax when you lose property because of a casualty or condemnation yet have gain. Completing the 8824 in part i complete. A 1033 exchange does not require the use of a qualified intermediary (you can take the proceeds of the sale as long as you. Web xchange solutions is a.

1033 Exchange / Eminent Domain Reinvestment

Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most. Web comparing sections 1033 and 1031. Web this page tells you about: Select add new on your dashboard and upload a file from your device or import it from the cloud, online, or. A 1033 exchange does not require.

Web xchange solutions is a member of the federation of exchange accommodators, the largest national professional association. Completing the 8824 in part i complete. Web an involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under. Web ipx1031 focuses solely on tax deferred exchanges. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most. Select add new on your dashboard and upload a file from your device or import it from the cloud, online, or. As the national leader in 1031 exchange services, ipx1031 has the. Web this page tells you about: Web a 1033 exchange is a useful tool to defer tax when you lose property because of a casualty or condemnation yet have gain. Web gain or loss.2 sales and exchanges.2 partial dispositions of macrs property.5 abandonments.5 foreclosures and. Web a 1033 exchange is available to those who have had their property condemned under eminent domain or because of natural. Disposing of the original asset asset entry worksheet step 2: Have you done everything you can to settle? Web section 1033 of the internal revenue code of 1954 provides for the nonrecognition of gain when the property is compulsorily or. An exchange of city property for. Web comparing sections 1033 and 1031. Web there are some key differences between exchanges. A 1033 exchange does not require the use of a qualified intermediary (you can take the proceeds of the sale as long as you. Web qualified replacement property is property acquired (i) by purchase, (ii) within the replacement period, (iii) with the intent of replacing the converted property, and. Web during the 2015 tax year, it conducts a 1031 exchange by relinquishing california property (rq) and replacing it with property located.

An Exchange Of City Property For.

Web during the 2015 tax year, it conducts a 1031 exchange by relinquishing california property (rq) and replacing it with property located. Select add new on your dashboard and upload a file from your device or import it from the cloud, online, or. Web ipx1031 focuses solely on tax deferred exchanges. Web gain or loss.2 sales and exchanges.2 partial dispositions of macrs property.5 abandonments.5 foreclosures and.

Web Section 1033 Of The Internal Revenue Code Of 1954 Provides For The Nonrecognition Of Gain When The Property Is Compulsorily Or.

Web there are some key differences between exchanges. A 1033 exchange does not require the use of a qualified intermediary (you can take the proceeds of the sale as long as you. Have you done everything you can to settle? Web a 1033 exchange is a useful tool to defer tax when you lose property because of a casualty or condemnation yet have gain.

Completing The 8824 In Part I Complete.

As the national leader in 1031 exchange services, ipx1031 has the. Web an involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under. Web this page tells you about: Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most.

Web Qualified Replacement Property Is Property Acquired (I) By Purchase, (Ii) Within The Replacement Period, (Iii) With The Intent Of Replacing The Converted Property, And.

Disposing of the original asset asset entry worksheet step 2: Web a 1033 exchange is available to those who have had their property condemned under eminent domain or because of natural. Web xchange solutions is a member of the federation of exchange accommodators, the largest national professional association. Web comparing sections 1033 and 1031.