1031 Exchange Calculation Worksheet - Get access to free 1031 exchange delaware statutory trust property listings Web purchase price, exchange property $ 6 less depreciation taken to date of sale ( ) 7 less deferred gain from previous 1031 exchange (if any) ()8 net. Web requires only 10 inputs into a simple excel spreadsheet. Find your ideal replacement asset. Web fact checked by marcus reeves. Web each concept is discussed below. Calculate the taxes you can defer when selling a property. Web if you’re considering performing a 1031 tax exchange instead of a taxable sale of a property, this calculator will help you. Web enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. Own real estate without dealing with the tenants, toilets and trash.

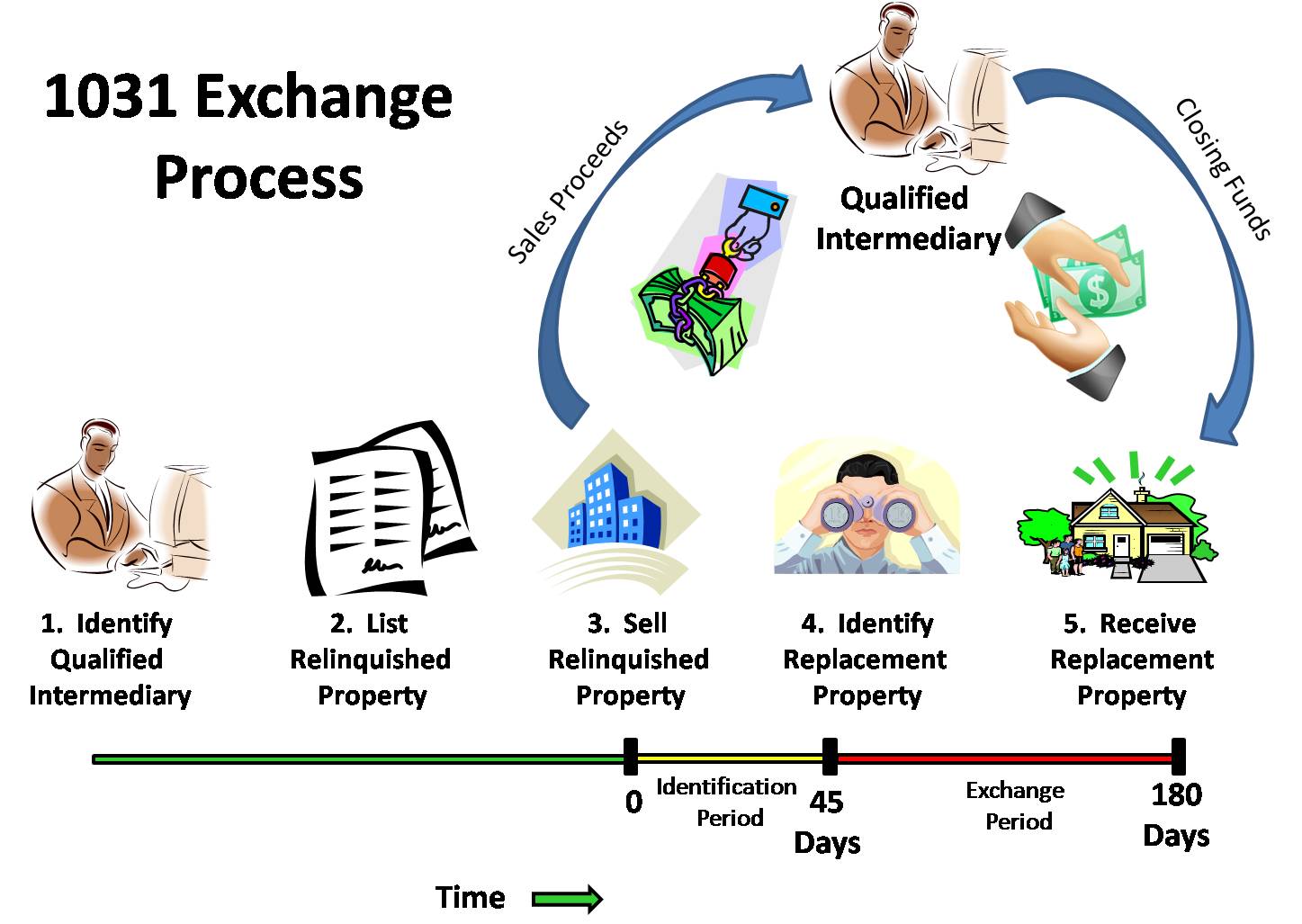

1031 Exchange Discover 1031 Investment Rules

Web exchanges limited to real property. Web each concept is discussed below. Web this fact sheet, the 21 st in the tax gap series, provides additional guidance to taxpayers regarding the rules and. Calculate the taxes you can defer when selling a property. Ad delaware statutory trust 1031 exchange.

Material Takeoff Template Excel Template 1 Resume Examples Ebw9je727x

Find your ideal replacement asset. Calculate the taxes you can defer when selling a property. Web requires only 10 inputs into a simple excel spreadsheet. $415,000 — cost basis of acquired property. Own real estate without dealing with the tenants, toilets and trash.

2021 Qualified Dividends And Capital Gains Worksheet Line12A

Web each concept is discussed below. Web exchanges limited to real property. Ad delaware statutory trust 1031 exchange. Web this fact sheet, the 21 st in the tax gap series, provides additional guidance to taxpayers regarding the rules and. Web here are the steps:

30 1031 Exchange Calculation Worksheet support worksheet

Web this calculator can give you an idea of how much in taxes you would pay if you decide to sell outright without completing a 1031. Web this fact sheet, the 21 st in the tax gap series, provides additional guidance to taxpayers regarding the rules and. Web fact checked by marcus reeves. Web exchanges limited to real property. Web.

Irs 1031 Exchange Worksheet And Partial 1031 Exchange Calculator

Get access to free 1031 exchange delaware statutory trust property listings See below for an example and explanation. Ad delaware statutory trust 1031 exchange. Web here are the steps: Web fact checked by marcus reeves.

1031 Exchange Worksheet Strum Wiring

Web each concept is discussed below. Ad delaware statutory trust 1031 exchange. Web if you’re considering performing a 1031 tax exchange instead of a taxable sale of a property, this calculator will help you. Web purchase price, exchange property $ 6 less depreciation taken to date of sale ( ) 7 less deferred gain from previous 1031 exchange (if any).

1031 Exchange Calculation Worksheet CALCULATORVGW

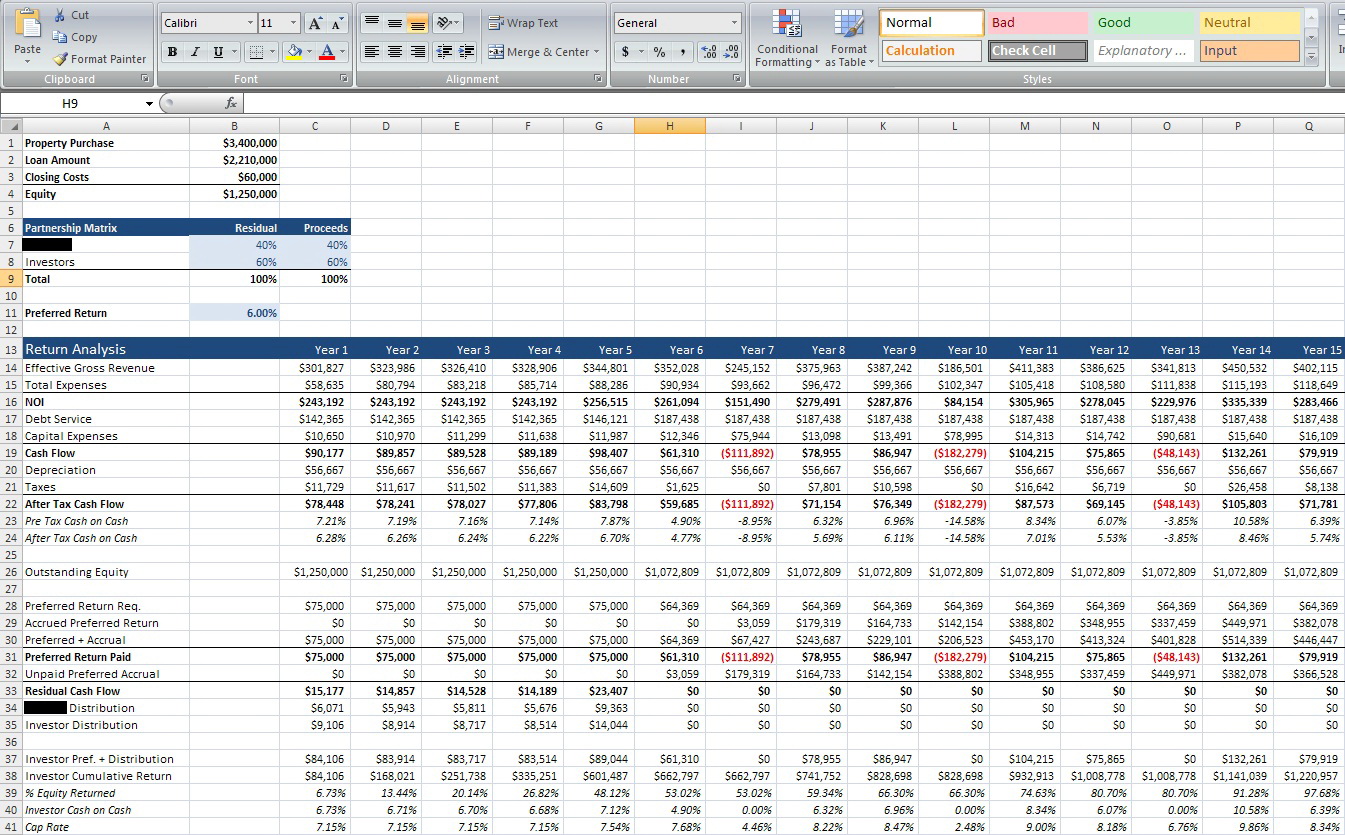

Web enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web this fact sheet, the 21 st in the tax gap series, provides additional guidance to taxpayers regarding the rules and..

1031 Exchange (FAQs & Calculator)

Web enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. Web if you’re considering performing a 1031 tax exchange instead of a taxable sale of a property, this calculator will help you. Own real estate without dealing with the tenants, toilets and trash. Calculating taxes due upon.

1031 Exchange Calculation Worksheet

Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web this calculator can give you an idea of how much in taxes you would pay if you decide to sell outright without completing a 1031. Ad delaware statutory trust 1031 exchange. See below for an example and explanation. Web fact checked by marcus.

1031 Exchange Calculation Worksheet CALCULATORVGW

Web exchanges limited to real property. Calculating taxes due upon sale vs 1031 exchange as a starting point, a. Web if you’re considering performing a 1031 tax exchange instead of a taxable sale of a property, this calculator will help you. Web each concept is discussed below. Get access to free 1031 exchange delaware statutory trust property listings

To pay no tax when executing a. Web fact checked by marcus reeves. Own real estate without dealing with the tenants, toilets and trash. Web here are the steps: Web each concept is discussed below. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Get access to free 1031 exchange delaware statutory trust property listings Web enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. See below for an example and explanation. Find your ideal replacement asset. Web this calculator can give you an idea of how much in taxes you would pay if you decide to sell outright without completing a 1031. Web purchase price, exchange property $ 6 less depreciation taken to date of sale ( ) 7 less deferred gain from previous 1031 exchange (if any) ()8 net. Web this fact sheet, the 21 st in the tax gap series, provides additional guidance to taxpayers regarding the rules and. Ad delaware statutory trust 1031 exchange. $415,000 — cost basis of acquired property. Web exchanges limited to real property. A 1031 exchange is a swap of one real estate investment property for. Calculating taxes due upon sale vs 1031 exchange as a starting point, a. Ad #1 crowdfunding platform for 1031s. Calculate the taxes you can defer when selling a property.

Calculate The Taxes You Can Defer When Selling A Property.

Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. A 1031 exchange is a swap of one real estate investment property for. Ad #1 crowdfunding platform for 1031s. To pay no tax when executing a.

Web Fact Checked By Marcus Reeves.

Web exchanges limited to real property. Web enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. Web if you’re considering performing a 1031 tax exchange instead of a taxable sale of a property, this calculator will help you. Web each concept is discussed below.

Web This Calculator Can Give You An Idea Of How Much In Taxes You Would Pay If You Decide To Sell Outright Without Completing A 1031.

Get access to free 1031 exchange delaware statutory trust property listings Own real estate without dealing with the tenants, toilets and trash. See below for an example and explanation. Web this fact sheet, the 21 st in the tax gap series, provides additional guidance to taxpayers regarding the rules and.

Calculating Taxes Due Upon Sale Vs 1031 Exchange As A Starting Point, A.

Ad delaware statutory trust 1031 exchange. Find your ideal replacement asset. Web here are the steps: $415,000 — cost basis of acquired property.