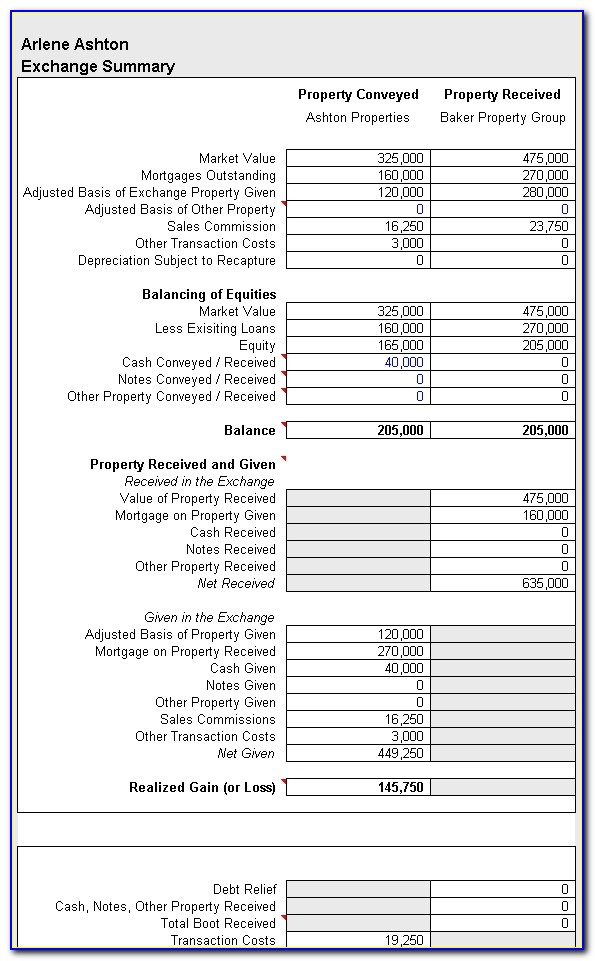

1031 Exchange Basis Worksheet - Web 3.3 cost basis for unqualified property: Web the following is a worksheet to calculate basis in replacement property. Enter the total of line 3.1 plus 3.2 to set the cost basis in the unqualified property received in exchange for the property. Web section 1031 provides that no gain or loss is recognized. In deferring those gains, your basis has to be. Ad no hassle, hands off management with dst 1031 property exchanges. Web 1031 exchanges allow taxpayers to defer capital gains. $300,000 / total replacement property value of $1,200,000 = 0.25. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a. Ad delaware statutory trust 1031 exchange.

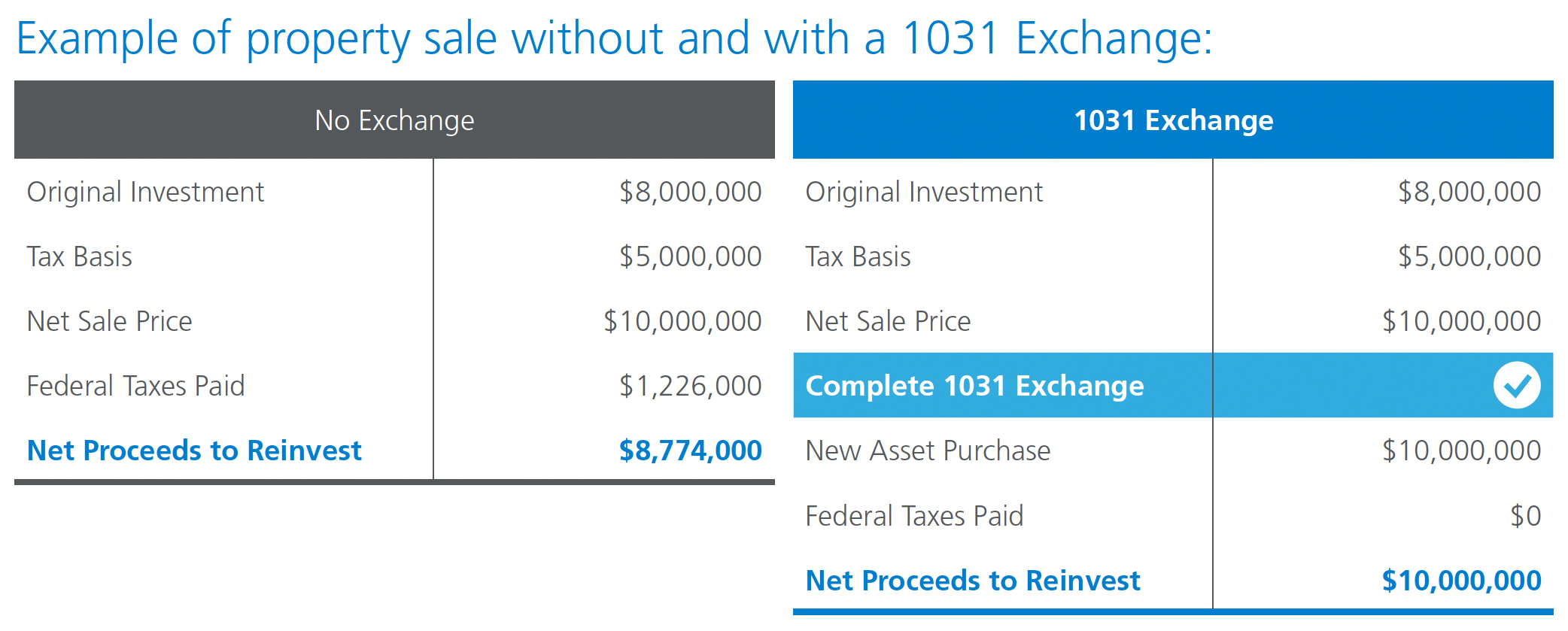

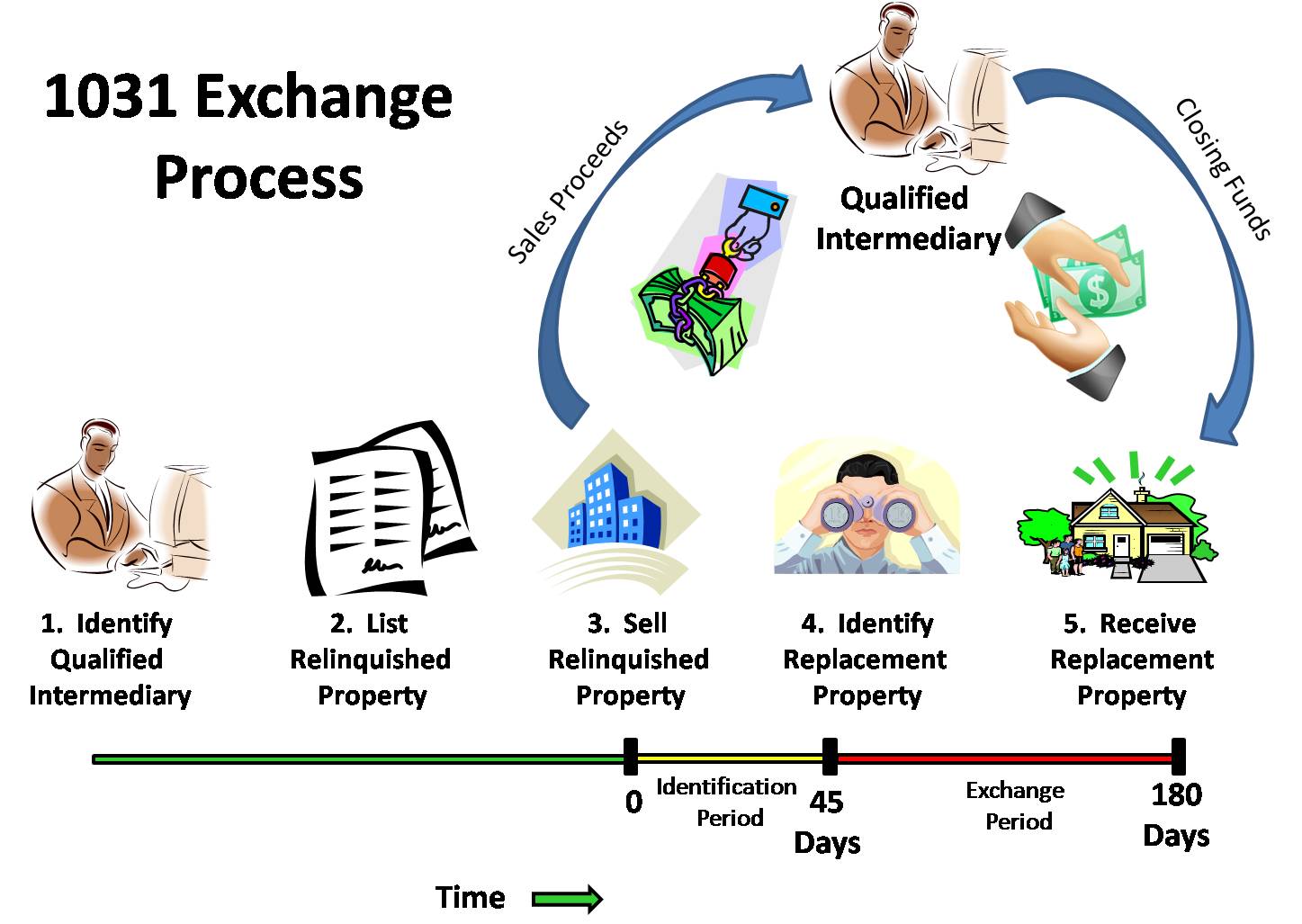

What is a 1031 Exchange?

Get access to free 1031 exchange delaware statutory trust property listings Ad no hassle, hands off management with dst 1031 property exchanges. In deferring those gains, your basis has to be. Web section 1031 provides that no gain or loss is recognized. $300,000 / total replacement property value of $1,200,000 = 0.25.

1031 Exchange Financing Bridge Loans Wilshire Quinn Capital

Ad delaware statutory trust 1031 exchange. See here for more details. Web 2019 1031 exchange reporting guide helping to simplify the reporting of your 1031 exchange introduction in our. Web section 1031 provides that no gain or loss is recognized. 0.25 * total deferred gains of $500,000 =.

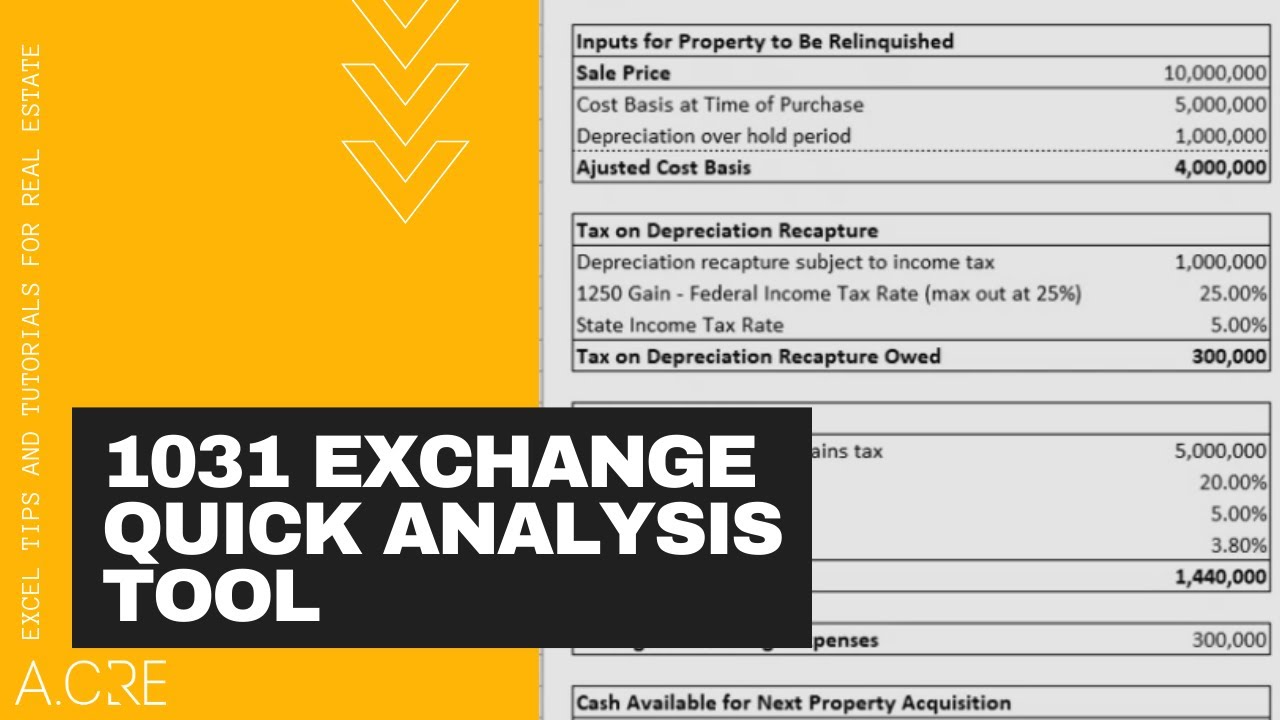

1031 Exchange Worksheet Excel Ivuyteq

Web the following is a worksheet to calculate basis in replacement property. Web form 8824 worksheetworksheet 1 tax deferred exchanges under irc § 1031 date closed taxpayer exchange property replacement. In deferring those gains, your basis has to be. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a..

Benefits of a 1031 Exchange YouTube

Enter the total of line 3.1 plus 3.2 to set the cost basis in the unqualified property received in exchange for the property. In deferring those gains, your basis has to be. Web 2019 1031 exchange reporting guide helping to simplify the reporting of your 1031 exchange introduction in our. 0.25 * total deferred gains of $500,000 =. $300,000 /.

1031 Exchange Worksheet Live Worksheet Online

In deferring those gains, your basis has to be. Web 1031 exchanges allow taxpayers to defer capital gains. Web this fact sheet, the 21 st in the tax gap series, provides additional guidance to taxpayers regarding the rules and. 0.25 * total deferred gains of $500,000 =. Enter the total of line 3.1 plus 3.2 to set the cost basis.

Partial 1031 Exchange Worksheet

Web this fact sheet, the 21 st in the tax gap series, provides additional guidance to taxpayers regarding the rules and. Web section 1031 provides that no gain or loss is recognized. Web 3.3 cost basis for unqualified property: Enter the total of line 3.1 plus 3.2 to set the cost basis in the unqualified property received in exchange for.

1031 Exchange Calculation Worksheet

In deferring those gains, your basis has to be. Ad no hassle, hands off management with dst 1031 property exchanges. Web 3.3 cost basis for unqualified property: Web this fact sheet, the 21 st in the tax gap series, provides additional guidance to taxpayers regarding the rules and. Web section 1031 provides that no gain or loss is recognized.

1031 Exchange Discover 1031 Investment Rules

Web section 1031 provides that no gain or loss is recognized. Web the following is a worksheet to calculate basis in replacement property. $300,000 / total replacement property value of $1,200,000 = 0.25. In deferring those gains, your basis has to be. Web 3.3 cost basis for unqualified property:

1031 Exchange Calculation Worksheet

$300,000 / total replacement property value of $1,200,000 = 0.25. Web 3.3 cost basis for unqualified property: Ad delaware statutory trust 1031 exchange. Web section 1031 provides that no gain or loss is recognized. Web the following is a worksheet to calculate basis in replacement property.

Section 1031 Exchange The Ultimate Guide to LikeKind Exchange

Enter the total of line 3.1 plus 3.2 to set the cost basis in the unqualified property received in exchange for the property. In deferring those gains, your basis has to be. Web 1031 exchanges allow taxpayers to defer capital gains. See here for more details. Web the following is a worksheet to calculate basis in replacement property.

In deferring those gains, your basis has to be. Web section 1031 provides that no gain or loss is recognized. Enter the total of line 3.1 plus 3.2 to set the cost basis in the unqualified property received in exchange for the property. Get your free time back w/ passive dst investments. Get access to free 1031 exchange delaware statutory trust property listings See here for more details. Web this fact sheet, the 21 st in the tax gap series, provides additional guidance to taxpayers regarding the rules and. Web 3.3 cost basis for unqualified property: Ad delaware statutory trust 1031 exchange. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a. Web form 8824 worksheetworksheet 1 tax deferred exchanges under irc § 1031 date closed taxpayer exchange property replacement. 0.25 * total deferred gains of $500,000 =. Ad no hassle, hands off management with dst 1031 property exchanges. $300,000 / total replacement property value of $1,200,000 = 0.25. Web 2019 1031 exchange reporting guide helping to simplify the reporting of your 1031 exchange introduction in our. Web 1031 exchanges allow taxpayers to defer capital gains. Web the following is a worksheet to calculate basis in replacement property.

Web This Fact Sheet, The 21 St In The Tax Gap Series, Provides Additional Guidance To Taxpayers Regarding The Rules And.

0.25 * total deferred gains of $500,000 =. Ad delaware statutory trust 1031 exchange. Get your free time back w/ passive dst investments. Web 1031 exchanges allow taxpayers to defer capital gains.

Web 3.3 Cost Basis For Unqualified Property:

Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a. Enter the total of line 3.1 plus 3.2 to set the cost basis in the unqualified property received in exchange for the property. Get access to free 1031 exchange delaware statutory trust property listings In deferring those gains, your basis has to be.

Web 2019 1031 Exchange Reporting Guide Helping To Simplify The Reporting Of Your 1031 Exchange Introduction In Our.

Web form 8824 worksheetworksheet 1 tax deferred exchanges under irc § 1031 date closed taxpayer exchange property replacement. $300,000 / total replacement property value of $1,200,000 = 0.25. Web the following is a worksheet to calculate basis in replacement property. See here for more details.

Ad No Hassle, Hands Off Management With Dst 1031 Property Exchanges.

Web section 1031 provides that no gain or loss is recognized.